Illumination

In 2014, light-emitting diodes (LEDs) continued to increase their dominance of the sign illumination market. The global use of LED packaged chips in signage and professional displays is forecast to grow by nearly 12 per cent annually, according to the latest data from market research firm ElectroniCast Consultants (see page 44). With a growing number of suppliers, however, it can be challenging for signmakers to determine which products are the best fit for their projects.

Aside from internally illuminating channel letters, lightboxes and other static signs, LEDs are in high demand for electronic message centres (EMCs). This market has, as yet, seen a relatively small number of upstream suppliers of the LEDs themselves, but sign shops enjoy the benefits of strong competition because they can buy LED-based EMCs directly from manufacturers, wholesalers, distributors or online resellers. There is also the option of renting portable EMCs for temporary use, rather than buying and installing permanent models.

“Thanks to these factors, the market is in great condition for sign shops and other buyers looking to negotiate low prices,” says Michelle Hovanetz, research analyst for IBISWorld. “Competition is further increased because variable-message signs are fairly standardized and thus comparable across most brands. And the costs of switching between suppliers are low.”

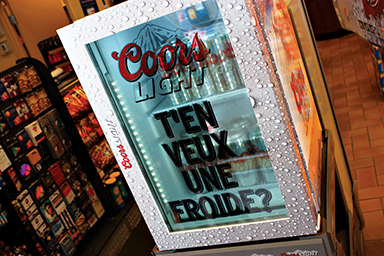

Digital signage has become more pervasive in retail environments, with examples including this see-through fridge door screen.

Digital signage

In 2014, the global market for digital signage, measured in terms of shipments of flat-panel screens for commercial purposes, benefited from high-profile events like the Winter Olympic Games in Sochi, Russia, and the Fédération Internationale de Football Association (FIFA) World Cup in Brazil. Even in North America, digital signage network operators took advantages of the Olympics and World Cup for greater visibility, subscribing to custom news feeds that allowed them to display the latest standings, photos and video clips. And as the medium has become global in nature, many companies within Canada have benefited from broader exposure.

With the vast and rapidly evolving ‘Internet of things,’ whereby billions of devices are connected and communicating with each other 24-7, largely without human intervention, studies suggest the business opportunities for the digital signage industry have never been better. The world of information and communications technology (ICT) is in the midst of a dramatic transformation, moving away from isolated systems and toward Internet-enabled devices that are networked through the ‘cloud.’

As a result, the Internet of things is becoming one of the most important technological developments of the 21st century. By the year 2025, research by chipmaker Intel shows between two to three billion people will be connected via the Internet, but the number of connected and communicating devices may top one trillion.

Digital signs are among these devices that can take better advantage of networking, particularly in terms of using ‘big data’ for analytics purposes. Information generated and shared across systems can help guide better, automated decision-making. Interactive displays, for example, can collect individual information and then customize on-screen content accordingly, based on back-end demographic data.

Indeed, the Internet of things has already made its presence felt in the digital signage industry, particularly in retail environments. ‘Smart’ shelf labels, kiosks, point-of-sale (POS) displays and screens relating to surveillance and safety are all prime examples of this trend in action.

This reality creates its own security demands. New software capabilities will need to be integrated with hardware, so clients can be reassured additional devices will remain safe and secure when operating within the larger Internet of things.

Another trend affecting the industry has been the growing prominence of ultra-high-definition (UHD) panels (see page 58). According to the IHS Technology’s digital signage analysis service, shipments of UHD panels—also known as ‘4K’ displays—intended specifically for digital out-of-home (DOOH), communication and commercial applications in the digital signage market were poised to reach 145,000 units in 2014, up nearly 600 per cent from a mere 21,000 units in 2013. As such, 2014 marked the first real ‘growth spurt’ for the panels after an initially low customer base.

Following this tremendous surge, IHS anticipates the market will continue to support further expansion in the years to come, with UHD digital signage shipments approaching 656,000 by 2018. And as the technology becomes more readily available, display costs are expected to decline.