2015 State of the Industry report

by all | 27 November 2014 10:13 am

[1]Compiled by Peter Saunders

[1]Compiled by Peter Saunders

Sign Media Canada takes a look at the sign industry and what the future has in store.

It has been several years now since the Canadian sign and billboard industry suffered the negative impacts of a global recession—and market dynamics have certainly changed for the better. In 2009, many advertisers tightened their spending amid falling corporate profits. Prior to a decline in domestic demand, reduced demand from the U.S. caused the Canadian sign industry to suffer. Market research firm IBISWorld reports export revenues fell at an average rate of 4.4 per cent over the past five years.

Today, however, sales are recovering, with IBISWorld estimating a revenue growth rate of 1.3 per cent in 2014 and continued improvement as sign customers increase their dedicated budgets for advertising and corporate rebranding. In particular, the firm suggests they will source more digital signage, continuing a trend that began in the early 2000s, so sign companies that are prepared to offer and incorporate video displays into their projects are expected to lead the industry’s recovery.

That said, the ‘bread and butter’ of the sign industry remains wide- format printing.

Wide-format printing

Looking back, the digital wide-format printing sector has grown rapidly, with a proliferation of manufacturers reaching a high level of business maturity in less than 20 years. Today, however, consolidation is shrinking their numbers, new startups are very rare and digital signage could pose a market threat.

Major companies with diverse interests in the printing industry, such as HP and Agfa, entered the wide-format graphics market years ago. Other companies, including Inca Digital and Mimaki, established themselves primarily within the wide-format segment.

Screenprinting, which for many years was the predominant technology for producing display graphics, has continued to lose ground. The effects of the 2008 economic downturn were particularly strong in the screenprinting market, as many sign and print shops stopped investing in older equipment.

[2]

[2]The digital wide-format printing sector grew rapidly due to reduced setup requirements, more cost-effective short-run workflows, rapid response time and consistent output for repeat orders.

While screenprinting is now confined to a role as ‘legacy’ technology, however, Smithers Pira—a print-industry testing, consulting and information services business—argues it will retain an important position for several decades yet, as it can still lay down very heavy ink coverage more cheaply than digital inkjet printers. The gradual decline will continue, the company predicts, but with a ‘long tail.’

Worldwide, Smithers Pira forecasts screenprinting’s share of wide-format machinery will fall from its previously recorded 30 per cent in 2011 to 22 per cent by 2017. The replacement of screenprinters has been most significant in regions with environmental sustainability initiatives, where companies are quicker to adopt ultraviolet-curing (UV-curing) and durable aqueous ‘latex’ inkjet printers.

Other factors influencing the shift to digital printing include reduced setup requirements, more cost-effective short-run workflows, rapid response time and consistent output for repeat orders. In addition, wide-format digital printing has seen reliability and productivity increase and costs decrease. Perhaps most importantly, a growing number of applications have become feasible for digital printers to output (see page 32).

Digital signage, meanwhile, has long been considered a potential threat to printing, but without taking away significant market share. The emergence of flexible screens, however, may be better-suited to many signage applications. Roll-to-roll manufacturing could conceivably create low-weight digital displays that are cost-competitive with wide-format printed graphics.

In the meantime, the worldwide large-format printer market continues to find new opportunities for growth, according to studies by International Data Corporation (IDC), even if shipments to sign shops have become relatively flat. In early 2014, IDC reported overall shipments of large-format printers around the world had increased by 4.1 per cent in the fourth quarter (Q4) of 2013, compared to the same quarter in 2012, reaching approximately 82,000 units. Mature markets saw 3.6 per cent growth year-over-year, while emerging markets saw a 4.8 per cent increase.

Canada, for its part, has been among the markets recording the highest year-over-year increases. In Q1 of 2014, IDC reports growth in Canada’s graphic applications market segment reached 12.8 per cent. Other leading territories included Japan with 22.4 per cent and the Middle East and Africa with 18.7 per cent.

The real key to growth, however, has been to garner favour among other, less traditional user groups.

[3]

[3]Environmental sustainability initiatives have accelerated the adoption of UV-curing inkjet printers.

“There are multiple opportunities,” explained Phuong Hang, director of IDC’s worldwide large-format printer tracker program. “Improved speeds and image quality can boost aqueous inkjet printer sales into the technical market, for instance, and latex ink-based products will also grow.”

Indeed, the technical sector now represents 60 per cent of the total large-format printer market around the world, according to IDC, compared to 40 per cent for graphic applications.

Another recent industry research report from MarketsandMarkets predicts the global large-format inkjet printer market will be worth $12.5 billion by 2016, thanks to a compound annual growth rate (CAGR) of 5.7 per cent, which the report credited to the speed, flexibility and cost-effectiveness of today’s machines. As improved piezoelectric inkjet printheads achieve higher resolutions, for example, these machines are being adopted for photographic-quality printing.

In comparison to more expensive printing technologies like dye sublimation, inkjets continue to offer a lower cost per graphic panel and the advantage of needing practically no warm-up time. Wide-format inks have also become environmentally friendlier with the mainstream acceptance of both UV-curable and latex inks, which contain few to zero volatile organic compounds (VOCs).

“Shipments of UV-curing printers have been growing steadily over the past three years,” said IDC’s Hang. “We expect this trend to continue at a similar pace over the next three years.”

The rise of three-dimensional (3-D) printing has helped bring attention to the industrial printing sector, where analogue methods—including not only screenprinting, but also gravure and flexography—continue to prevail, providing a sizeable opportunity for digital technologies to reduce overall costs and expand the range of potential applications.

The industrial use of print technologies borrowed from the graphic arts industry started many years ago. Already, there are many situations where printing is integrated into a manufacturing process to contribute to the functionality and/or esthetics of an end product.

[4]

[4]Latex inks have also gained mainstream acceptance.

Fibreboard decoration, for example, has long mimicked wood textures on furniture and appliances at a much lower cost than sourcing actual wood panels. The fibreboard items are covered with melamine-impregnated paper and a protective layer before being pressed together at a high temperature. The paper is typically gravure-printed with the desired texture by third parties supplying quantities of 50,000 m2 (538,196 sf) or greater.

If furniture manufacturers want shorter run lengths, however, or wish to incorporate printing into their own processes, then digital inkjet technology and UV-curable inks may make inroads in this sector. The same is true for other industrial material surfaces, including tiles, textiles and glass.

In this sense, industrial printing could follow the example of sign and display printing, where inkjet technology has already led to faster job completion and strong adhesion of inks to difficult substrates. Further, the growth of industrial printing, unlike other markets, is not determined by the demand for printed information, but instead by consumer demand for practical products and appliances—which is certainly continuing to rise.

Illumination

In 2014, light-emitting diodes (LEDs) continued to increase their dominance of the sign illumination market. The global use of LED packaged chips in signage and professional displays is forecast to grow by nearly 12 per cent annually, according to the latest data from market research firm ElectroniCast Consultants (see page 44). With a growing number of suppliers, however, it can be challenging for signmakers to determine which products are the best fit for their projects.

Aside from internally illuminating channel letters, lightboxes and other static signs, LEDs are in high demand for electronic message centres (EMCs). This market has, as yet, seen a relatively small number of upstream suppliers of the LEDs themselves, but sign shops enjoy the benefits of strong competition because they can buy LED-based EMCs directly from manufacturers, wholesalers, distributors or online resellers. There is also the option of renting portable EMCs for temporary use, rather than buying and installing permanent models.

“Thanks to these factors, the market is in great condition for sign shops and other buyers looking to negotiate low prices,” says Michelle Hovanetz, research analyst for IBISWorld. “Competition is further increased because variable-message signs are fairly standardized and thus comparable across most brands. And the costs of switching between suppliers are low.”

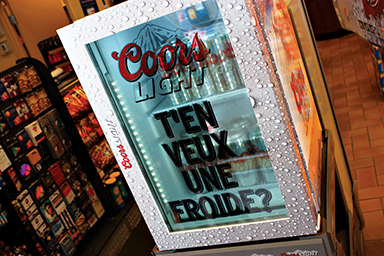

Digital signage has become more pervasive in retail environments, with examples including this see-through fridge door screen.

Digital signage

In 2014, the global market for digital signage, measured in terms of shipments of flat-panel screens for commercial purposes, benefited from high-profile events like the Winter Olympic Games in Sochi, Russia, and the Fédération Internationale de Football Association (FIFA) World Cup in Brazil. Even in North America, digital signage network operators took advantages of the Olympics and World Cup for greater visibility, subscribing to custom news feeds that allowed them to display the latest standings, photos and video clips. And as the medium has become global in nature, many companies within Canada have benefited from broader exposure.

With the vast and rapidly evolving ‘Internet of things,’ whereby billions of devices are connected and communicating with each other 24-7, largely without human intervention, studies suggest the business opportunities for the digital signage industry have never been better. The world of information and communications technology (ICT) is in the midst of a dramatic transformation, moving away from isolated systems and toward Internet-enabled devices that are networked through the ‘cloud.’

As a result, the Internet of things is becoming one of the most important technological developments of the 21st century. By the year 2025, research by chipmaker Intel shows between two to three billion people will be connected via the Internet, but the number of connected and communicating devices may top one trillion.

Digital signs are among these devices that can take better advantage of networking, particularly in terms of using ‘big data’ for analytics purposes. Information generated and shared across systems can help guide better, automated decision-making. Interactive displays, for example, can collect individual information and then customize on-screen content accordingly, based on back-end demographic data.

Indeed, the Internet of things has already made its presence felt in the digital signage industry, particularly in retail environments. ‘Smart’ shelf labels, kiosks, point-of-sale (POS) displays and screens relating to surveillance and safety are all prime examples of this trend in action.

This reality creates its own security demands. New software capabilities will need to be integrated with hardware, so clients can be reassured additional devices will remain safe and secure when operating within the larger Internet of things.

Another trend affecting the industry has been the growing prominence of ultra-high-definition (UHD) panels (see page 58). According to the IHS Technology’s digital signage analysis service, shipments of UHD panels—also known as ‘4K’ displays—intended specifically for digital out-of-home (DOOH), communication and commercial applications in the digital signage market were poised to reach 145,000 units in 2014, up nearly 600 per cent from a mere 21,000 units in 2013. As such, 2014 marked the first real ‘growth spurt’ for the panels after an initially low customer base.

Following this tremendous surge, IHS anticipates the market will continue to support further expansion in the years to come, with UHD digital signage shipments approaching 656,000 by 2018. And as the technology becomes more readily available, display costs are expected to decline.

The groundwork for this market trend was laid in 2013, when the first 4K digital signage was installed for a wayfinding system in McCarran International Airport in Las Vegas, Nev., followed by panels in Delta Airlines’ passenger lounges in other U.S. airports (see Sign Media Canada, November 2013, page 35). At the same time, technology firms began to unveil UHD-compatible content management software and media players.

Even as more 4K installations reach price-sensitive digital signage markets and content is repurposed from the consumer market, however, such panels will constitute a mere drop in the bucket compared to the overall UHD market. Shipments of UHD TVs, by way of comparison, were expected to reach 10 million units in 2014 and 40 million by 2018.

Many of the panel manufacturers, including LG, Samsung and Sony, are the same for both markets. IHS suggests this could muddle the distinction between consumer- and commercial-grade displays, which may be problematic given the specific requirements of the digital signage industry in terms of hardware and software for disseminating content.

[5]

[5]The first 4K digital signage system was installed in February 2013 at McCarran International Airport in Las Vegas, Nev., in time to welcome visitors to that year’s Digital Signage Expo (DSE).

Other obstacles include infrastructure and investment costs associated with upgrading digital signage networks, the requirement for additional bandwidth to support 4K content and the need to harmonize specifications for frame rates, brightness, dynamic range and other metrics that could be affected by resolution upgrades.

Further, IHS reports specialized screen manufacturers in the digital signage industry are facing a challenge from less expensive, consumer-grade TV panels. The company suggests the global signage and professional displays market would continue to see relatively flat revenues unless the industry can change some of its current dynamics. Overall revenue in 2014 was forecast to reach $13.76 billion, down from the 2012 total of $14 billion and up slightly from $13.58 billion in 2013. More significantly, no revenue projections from 2015 to 2018 exceed figures for 2014, despite a steady rise in screen shipments.

“The future for display vendors is going to be challenging,” says Sanju Khatri, IHS’s director of digital signage and professional video. “The industry faces tough competition as commercial establishments begin to use ordinary consumer TVs as replacements for specially outfitted digital signage displays.”

Educating buyers is paramount, Khatri says, since conventional TVs are not equivalent to the large-format liquid crystal display (LCD) panels designed for commercial signage use. Commercial-grade panels are built for longer wear, enclosed in metal chassis for improved heat dissipation and outfitted with special backlighting modules to ensure image clarity even under vivid ambient lighting. Some are also loaded with media players, sensors, touch interface modules and digital signage software.

Consumer TVs, on the other hand, are not designed for 24-7 use and will wear out much more quickly. They also cannot be joined together relatively seamlessly to form video walls.

So, despite the sobering market forecast, digital signage panel manufacturers can capitalize on premium features like high brightness, ultra-narrow bezels, interactivity and ultra-high-definition (UHD) resolution. The retail industry, by way of example, understands the value of digital signage and continues to represent a sizable market opportunity.

To further distance their products from conventional TVs, IHS suggests display manufacturers could team up with other hardware and software vendors to provide ‘all-in-one’ units capable of handling multiple sources of content, integrating with mobile communications and analyzing data.

Large format OOH ads attract a higher degree of attention than many other paid media.

OOH advertising

Behind the market performance of many wide-format printed graphics, illuminated signs and digital displays, of course, lies the strength of the out-of-home (OOH) advertising industry. According to a report conducted for the International Sign Association (ISA) by IHS and Vandiver Associates, for example, growth in the electric signage market in 2015 will largely depend on an estimated 15 per cent increase in OOH revenue.

“Large-format OOH provides huge benefits to brands, which receive a higher degree of attention than through other paid media,” said Carolin Baumann, group marketing director for BlowUp Media, after using eye-tracking technology to examine how people view posters and billboards. “Their sheer size allows images and messages to be communicated with greater emotion, which in turn leads to a more memorable campaign and a higher probability of purchasing an advertising product.”

Another study by Cog Research and psychologist Amanda Ellison combined eye-tracking technology with monitored skin conductance readings from 20 people as they went through their daily lives (see page 62). By matching the skin conductance highs and lows, which can measure emotional responses to external stimuli, to the subjects’ various actions and locations, the researchers ascertained people are 33 per cent more alert to ads when outside their homes.

“This research puts numbers to what we all sense,” said Mike Baker, CEO of the Outdoor Media Centre, an OOH trade organization, “namely that we move around out of home in a sharper and more focused frame of mind. Advertisers can use this ‘active’ space to target consumers at different points in their day.”

Predictions

“Ontario’s ‘golden horseshoe’ is still a dominant hub for the digital printing and sign business, but the Western provinces are fast becoming the economic engine of Canada and will offer many opportunities for print and sign shops. The biggest issue we still face is clients who used to want it tomorrow now expect it today. It is up to sales staff to set a reasonable fabrication timeline, as once you have committed to it, your client will hold you to it at your peril.”

– Chris Tyler, director of operations, Studio Signs Visual Media Group

“Growth in North America has been moderate and, anecdotally, we’ve been under the impression new sign shops are on the wane, but signmaking franchisors are seeing continued demand for their concepts. On a positivenote for signmakers, prices for digital printers appear to be declining. Unfortunately, the Canadian dollar—which was running at par with the U.S. dollar for a considerable period—has dropped to less than 90 cents, requiring price increases across the board for imported machines, media and inks.”

– Don Ross, national sales manager, Roland DGA Canada

“Overall, the industry is likely to regain momentum in 2015. The lower exchange rate with the U.S. results in increased exports from Canada and a slowly improving economy south of the border will help. In Toronto, which will host the Pan Am Games, many businesses will brush up their appearance with improvements in beautification and signage, which should benefit the industry in the first half of the year.”

– Udo Schliemann, principal creative director, Entro

“The use of LEDs in sign and display lighting applications is fully set in the growth stage of the product life cycle (PLC), especially in digital signage, commercial TV-type displays and large-format displays sourced through business-to-business (B2B) activities. There continues to be a significant difference between the average selling prices of standard LEDs and high-brightness (HB) LEDs.”

– Stephen Montgomery, president, ElectroniCast Consultants

“Digital signage is reinventing and redefining itself with architecturally driven displays, ultra-high resolution and multiple-level interactivity, including touch, gesture, mobile, social media and augmented reality (AR), as well as the creative use of sound, multimedia and blending with print and décor. The result will be an enhanced level of engagement for consumers.”

– Denys Lavigne, senior director of experiential strategy and creative services, Christie Digital

“Digital place-based media has grown up. It is no longer just about digital signage technology, but also about increasing the return on the marketing, retail design and communications investment for amplifying a brand, gaining desired actions, merchandising, promotion and engagement, while improving the ambiance, vitality and appeal of the location. ”

– Lyle Bunn, analyst and consultant, Bunn Co.

“The integration of accessibility signage in design-build projects will become more than just an adjunct accommodation to fulfil minimum code requirements. The esthetic properties that define signage will encompass more than just graphic design, which will help elevate signs beyond their ‘object’ properties to become active agents in facilitating the needs of the blind and visually impaired. Look for more tactile maps, braille integration and photopolymer-based signs in 2015 and beyond.”

– Keith Francis, director of strategic planning, Acumen Visual Group

“The digital billboard conversion process will continue to have a profound effect on OOH advertising, as the financial payback metrics are compelling. Conversions are also starting to occur with posters and other smaller-format OOH signage as resolution improves and costs for LEDs continue to drop. And there will be more real-time downloading of content specific to advertised brands, not just news, weather and sports.”

– Alan High, former president and general manager (GM), Clear Channel Spectacolor

With files from IBISWorld Canada, Smithers Pira, IDC Canada, MarketsandMarkets, Agfa Graphics, ElectroniCast Consultants, Intel, IHS Technology, ISA, BlowUp Media and the Outdoor Media Centre. For more information, visit www.ibisworld.ca, www.smitherspira.com, www.idc.ca, www.marketsandmarkets.com, www.agfagraphics.com, www.electronicastconsultants.com, www.intel.com, technology.ihs.com, www.signs.org, www.blowup-media.com, www.cogresearch.com and www.outdoormediacentre.org.uk.

- [Image]: http://www.signmedia.ca/wp-content/uploads/2014/11/Opener.png

- [Image]: http://www.signmedia.ca/wp-content/uploads/2014/11/Seiko_21425.png

- [Image]: http://www.signmedia.ca/wp-content/uploads/2014/11/M2050i.png

- [Image]: http://www.signmedia.ca/wp-content/uploads/2014/11/HP_Designjet.png

- [Image]: http://www.signmedia.ca/wp-content/uploads/2014/11/IMG_2938.png

Source URL: https://www.signmedia.ca/2015-state-of-the-industry-report/