By Stephen Bennett

It is no surprise many print service providers (PSPs) have been joining the wide-format graphics industry in recent years. Global sales of ink and media have experienced a compound annual growth rate (CAGR) of two per cent, reaching $3 billion and $29 billion, respectively, for a total of $32 billion; but the sellable output created with them has seen a CAGR of four per cent, reaching $42 billion. Compared to other print sectors, these are very attractive profit margins. And with growth in revenue continuing to outpace growth in costs of goods sold, the wide-format industry is clearly healthy.

The question is how PSPs will be able to charge more for sellable output in a changing market. At the moment, the broad range of viable options for digitally printed output includes signs, displays, packaging, collateral, labels and direct mail. It is important to understand how these various forms of printed output relate to consumers’ purchasing decisions.

Most outdoor signs, along with direct mail and printed collateral, typically contribute to exposure, motivation and recognition of the need for an advertised product. Research has demonstrated these aspects fuel 30 per cent of purchasing decisions.

The other 70 per cent of such decisions, however, are made at the point-of-purchase (POP), where retail displays, packaging and labels take on an elevated value for brand marketers. A recent survey conducted by the Path to Purchase Institute (P2PI) interviewed brand owners and found more than half of them responding with plans to put a greater emphasis on POP displays.

According to IT Strategies, a consultancy serving the digital print vendor community, POP and other in-store displays represent 70 to 80 per cent of demand among brand owners, while promotional packaging represents 15 to 25 per cent. The displays, whether two-dimensional (2-D) or three-dimensional (3-D), are typically made using corrugated or foam board and printed in medium- length runs averaging 300 pieces per job. The packaging, meanwhile, also uses corrugated board in 3-D configurations and commonly involves anywhere from one to 500 pieces per job. Demand for both applications is growing.

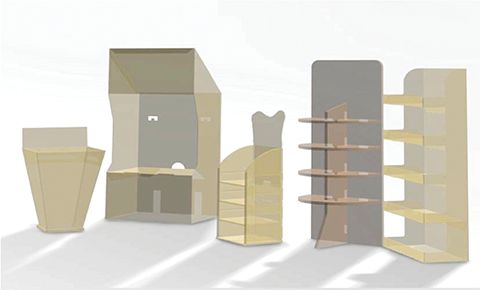

Graphic design software can be used to set up templates for a variety of POP and merchandising formats.

IT Strategies estimates $17 billion is now spent annually on POP applications, trending toward digital printers because they can more efficiently handle variable run lengths than analogue technologies could. Customers include mass retailers (40 per cent), brand owners (40 per cent), other ‘retailers’ like restaurants, hotels, movie theatres and museums (10 per cent) and advertising, marketing, promotional and public relations (PR) agencies (10 per cent).

Unsurprisingly, all major large-format digital printer vendors are targeting the packaging and POP markets with their production presses. The increased availability of white and metallic inks, for example, is in large part a response to the use of non-white substrates for packaging applications.

Similarly, in recent years, computer numerical control (CNC) cutters and routers have helped graphics producers automate their finishing processes. With these digital systems, it has become more economically feasible to produce complex shapes, differentiate short runs and add value to end products.

Avoiding pricing challenges

Within this context, however, there are certain challenges to be faced. One is turnaround—given current customer expectations of digital workflows, some 70 per cent of jobs need to be completed in two days or less (compared to 10 days in 1997). Another is pricing, which has become highly competitive for graphics based on square footage of printing.

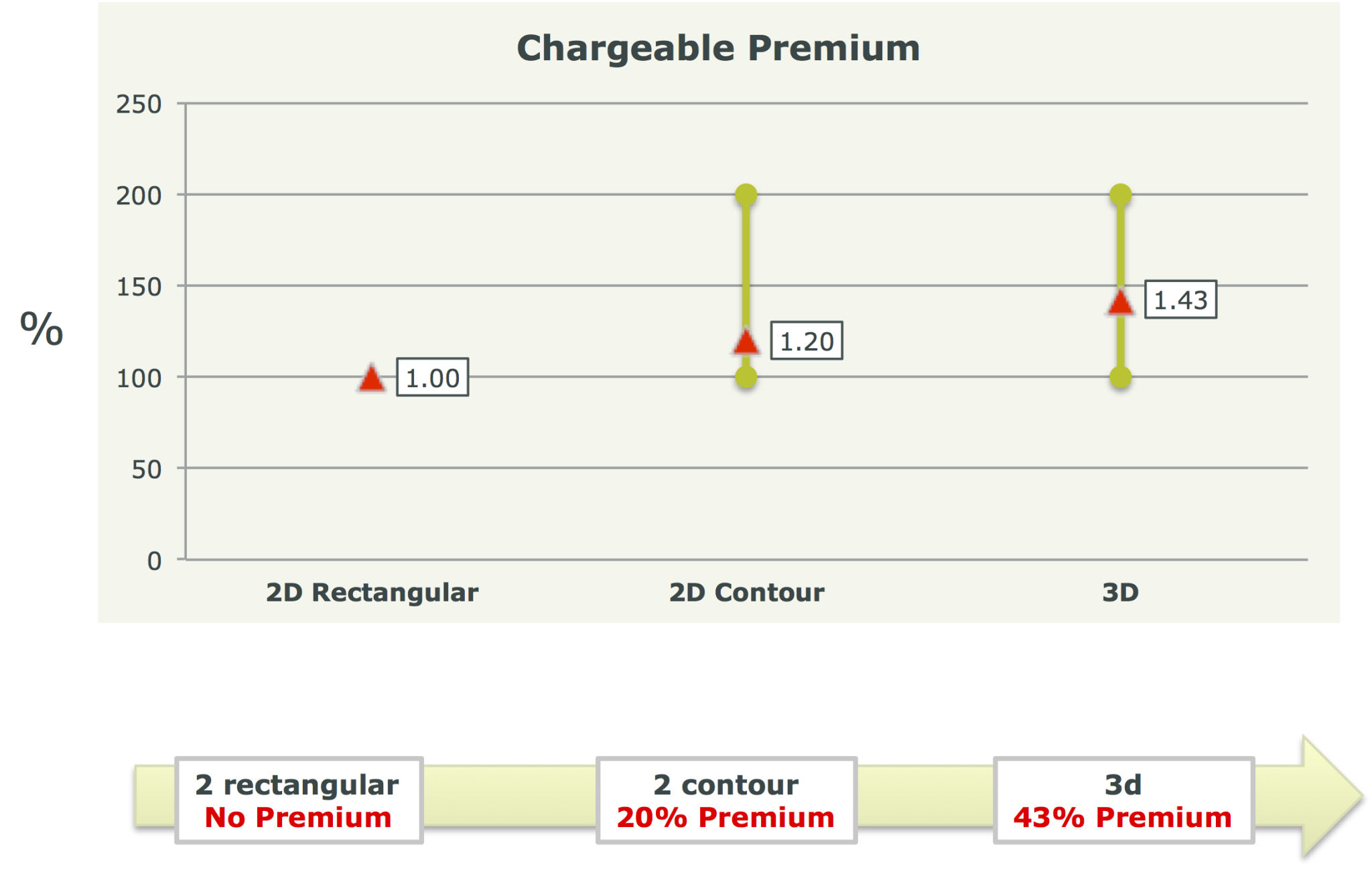

The answer to these challenges is to get out of square footage pricing and instead charge by the unit. In particular, additional value is attributed to POP displays that exceed 2-D rectangular formats (see Figure 1). For the same amount of effort, a contour-cut 2-D display in a unique shape can earn, on average, a 20 per cent premium, while a 3-D display can command a 43 per cent premium. This is not only because they require greater design considerations, but also because they are more impactful within retail environments.

Further, short-run jobs can earn more of a premium than long-run jobs (see Figure 2). This is because sign shops can charge ‘on demand’ prices, with examples ranging from no premium for a 550-piece run to a 20 per cent premium for a 200-piece run and a 54 per cent premium for a 50-piece run.

As a result, the premiums a print shop can charge based on the complexity of a job are significant. From a rectangular to contoured shape, it is possible to triple net margins; and from a rectangle to a 3-D display, the increase is five to eight times. Further, by offering creative design services in-house, shops can enjoy net margins as much as 30 times typical ‘rectangular shape’ pricing, as those services involve not only graphic design, but also structural design, testing for integrity and other responsibilities.