Photo courtesy Sport Chek

By Stephen Montgomery

The global market for the use of light-emitting diodes (LEDs) in signage and other professional displays is vast, as the application category covers a wide range of stationary and mobile (i.e. vehicle-based) signs and displays, including large outdoor video screens, scoreboards and other sports stadium displays, digital billboards, small indoor retail displays, taxi-top signs, destination signs on mass-transit vehicles, channel letters, lightboxes, backlit liquid crystal displays (LCDs), signals and many more.

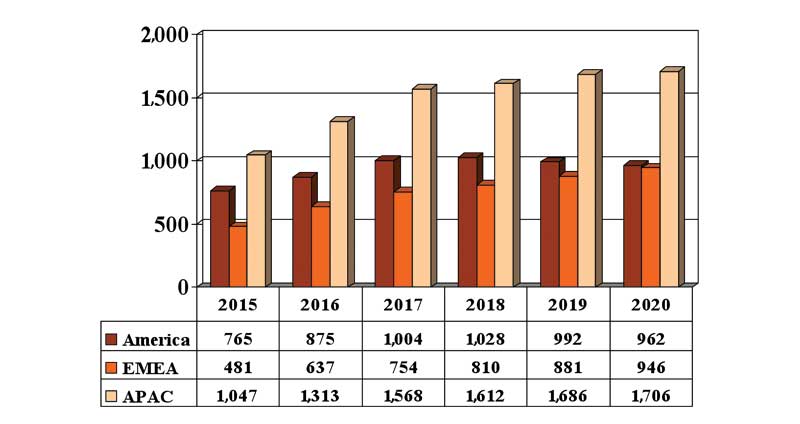

In 2015, the worldwide consumption value of packaged LEDs used in signage and professional displays reached nearly $2.3 billion U.S. By the year 2020, this value is forecast to top $3.6 billion U.S. (i.e. as per market forecast data referring to consumption within each particular calendar year, such that the data is not cumulative).

Within the Americas, the consumption value reached $765 million U.S. in 2015 and is expected to expand at an average annual rate of 4.7 per cent, peaking in 2018 at more than $1 billion U.S. before reducing slightly to $962 million U.S. in 2020 (see Figure 1).

The Asia-Pacific (APAC) region, meanwhile, is forecast to maintain its leadership position in relative market share throughout the same period, reaching $1.7 billion U.S. in 2020, at which point it will represent 47 per cent of global consumption value.

The Europe, Middle East and Africa (EMEA) region held a 21 per cent share of global consumption value in 2015 and is expected to experience an average annual growth rate of 14.5 per cent.

Packaged for use

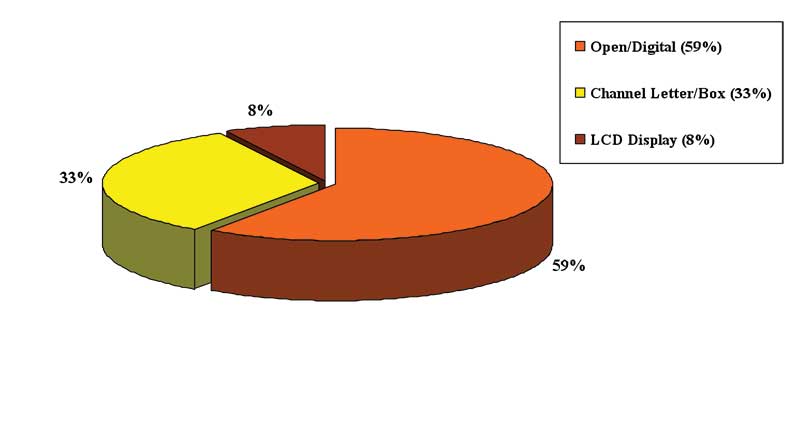

In the tracking of this market, LEDs are segmented into several package types, including dual in-line package (DIP), surface-mount diode (SMC), chip-on-board (COB) and multiple-COB (MCOB) LED products. Further, the use of each package type is segmented into different types of signs and displays, including digital signage, open-face displays, backlit channel letters, sign boxes and backlit professional LCD screens (see Figure 2).

The consumption value for DIP LEDs, for example, is forecast to increase in value by an average of 13 per cent per year. SMD LEDs, however, are expected to see negative growth, depending on the particular display type and the region, while COB and MCOB LEDs are set for strong increases in value of 71 per cent per year for the period from 2015 to 2020.

The use of both COB and MCOB LEDs in signage and display applications is relatively new. They have typically been considered a technology for general illumination applications, but they are now also finding their way into channel letters, sign panels and boxes, backlighting units (BLUs) for LCD screens and, for that matter, further research and development (R&D) efforts for the introduction of new products for signage and display applications.