By Peter Saunders

At first glance, the current state of the digital printing market appears positive. Revenues generated from large offset printing machines have dropped by more than 40 per cent at some points in recent years; and many of their well-known manufacturers, including Heidelberg, KBA and Manroland, have undergone repeated corporate restructurings. Despite such crises, however, the sales figures for inkjet printers have remained relatively stable since 2007.

Moreover, offset printing remains the dominant technology, representing 63 per cent of the overall market, so there are still large volumes of work that digital printing can potentially take over from offset printing.

Even so, the entire inkjet printing industry will also face considerable challenges in the coming years. It is already clear the current business models are no longer viable.

Raised awareness and rethinking

Digital printing can still be considered a ‘disruptive technology,’ as it is favoured by five major trends affecting the print sector:

- The digitization of web-to-print.

- Shorter print runs.

- Individualized printing.

- Super-wide formats.

- Emerging industrial applications.

These trends are forecast to drive inkjet printing growth rates of more than 10 per cent each year (i.e. measuring the total output of printed matter) until 2020.

The general trend toward digitization has raised consumers’ awareness of web-to-print services and products, such as the custom printing of personal photos on giftware, beyond standard advertising-oriented formats. At the same time, digitization has also caused advertising and marketing professionals to revise their own thinking. Today’s out-of-home (OOH) advertising campaigns are planned more accurately than in the past, resulting in shorter print runs. This has helped make digital printing more price-competitive for many projects that were previously only profitable by using offset printing or screenprinting.

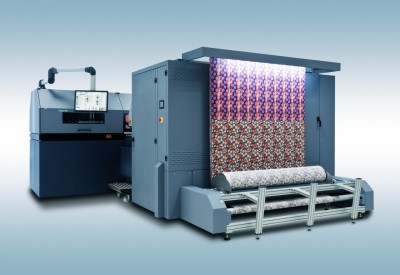

While digital printing as an industry benefits highly from the growing consumer demand for customized small-format print products, such as books, photo albums and other small-batch publications, large-format digital inkjet printing has created entirely new segments in OOH advertising by helping unique communications become eye-catching ‘events’ in the public sphere. And large-format printing can answer the growing demand for highly individualized consumer products, too, in areas like interior design, customized textiles for the home and apparel.

The large-format printing of vinyl graphics has diversified into areas like interior design and textiles.

A crisis at second glance

Despite these areas of growth, when surveyed in late 2012, many digital printing service providers reported sluggish order intake and significant price-margin pressures. The overall printing industry crisis, thus, is also reaching the digital printing sector, albeit in a diluted form.

The printing industry has lost many businesses since 2000 and surviving companies’ employee numbers have dropped. The impact of this drain can clearly be seen at major international trade expo events, such as the Drupa print media fair, which in 2012 saw attendance fall to 314,500, around the same level as in the 1980s.

Also, since as early as 2000, the volume of printed pages in industrialized countries has stopped growing in parallel to gross domestic product (GDP), but instead has become decoupled from it. In the coming years, this development will likely further intensify in the sign industry because major volumes of wide-format printed graphics are being lost to digital signage applications, particularly for the retail sector.

In the medium term, ‘mobile’ advertising via smart phones and tablet computers—whether direct, on websites or within social media—may also take over a growing share of retail messages and other previously printed communications. As a result, in the next few years, there will increasingly be a loss of business in printing pages for direct and transaction-oriented marketing in highly developed markets. And in emerging economies, expert analysts fear print-based advertising may even be completely skipped in favour of mobile and digital models. They even conclude the end of the growth of digital printing is in sight.