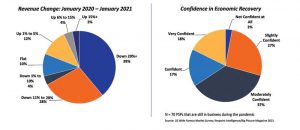

Although year-over-year revenue for wide-format print service providers (PSP) were down in 2021, most PSPs were moderately confident about an economic recovery. Photo courtesy Media Resources Inc.

By Eric Zimmerman and Eve Padula

It has been more than two years since the COVID-19 pandemic took the world by storm, and the changes that have occurred since then have been unprecedented. The wide-format printing industry was certainly not immune to these shifts. Signage and graphic communications are an essential part of our society, so many wide-format print service providers (PSPs) were able to pivot their applications and effectively weather the storm.

Although year-over-year revenue volumes were down in 2021, most PSPs were moderately confident about a near-term economic recovery.

Since volumes were down from pre-pandemic numbers, it should come as no surprise that most PSPs were cautious about their equipment purchases in 2021. In fact, nearly two-thirds (64 per cent) of PSPs were not planning on purchasing new equipment in early 2021. The good news is wide-format printing purchases have rebounded somewhat since that time.

Despite the disruptions of the COVID-19 pandemic, wide-format applications remained stable in relation to many other print applications. When PSPs were asked about the types of products that were seeing an increase in demand, the most common responses included signs, banners, and decals/stickers. Floor graphics also saw a spike in demand during the height of the pandemic when social distancing was enforced.

As we move through the remainder of 2022, the wide-format print industry will continue its recovery. However, even as demand increases, supply chain disruptions, labour shortages, and concerns about COVID-19 variants will continue to create challenges. This article provides a forecast overview and explores wide-format growth areas expected to help the industry regain lost volumes in 2022 and beyond.

Ink technology forecast

According to Keypoint Intelligence’s (KPI’s) most recent forecast data, placements of all wide- format technologies are expected to remain generally flat between 2019 and 2025. At the same time, however, this flatness should be viewed as a recovery based on the steep decline printer placements experienced across all ink technologies between 2019 and 2020. All technologies are expected to further recover as we move through the current forecast period.

It is important to note this forecast data would typically cover a five-year compound annual growth rate (CAGR) from between 2020 and 2025. That said, it is critical to establish a pre-COVID benchmark to measure the rate of recovery. To create a clear and realistic viewpoint of the market, KPI will be utilizing a six-year CAGR (2019-2025) in this article.

Aqueous

After performing under forecast in 2019 and then being confronted with the pandemic, the aqueous ink wide-format printer category saw a 25 per cent decline in unit sales between 2019 and 2020. The production segment experienced the largest rate of decline (38 per cent) year over year, as well as a 27 per cent drop in print volumes. In contrast, the creative segment saw the smallest decline in year-over-year unit sales (12 per cent). As a result, this category is expected to experience a quicker recovery through 2025.

While the overall segment is well on the way to recovery, it is quite likely it will still take some time to reach pre-pandemic placement levels.