COMMB report reveals 2020-21 travel patterns, consumer behaviours, traffic trends

Throughout 2020, Canadian Out of Home Measurement Bureau (COMMB) observed travel patterns to understand the effect on consumer behaviours and traffic trends.

The organization compiled a report—leveraging data from its members, Apple, Google, and other publicly sourced information—providing insights from 2020 to January 2021.

The data contained in this report represents general travel behaviour activity and does not apply to specific out-of-home (OOH) advertising locations, as travel patterns will vary based on road type within a market.

Travel behaviours correlated to increased cases and lockdown restrictions

Traffic data was reviewed to assess changes to travel behaviour since the onset of the COVID-19 pandemic. The assessment included sourcing mobile location data on more than 12,000 geo-fenced static and digital outdoor advertising faces, publicly available data sources such as Apple, and geolocation mapping applications that provide insights such as driving direction. Data from these sources was analyzed and output for multi-week periods to provide insight and illustrate a representative snapshot of travel behaviour—by market as well as a seven-market average.

Certain provinces experienced a second wave of lockdowns due to an increase in the number of COVID-19 cases. This occurred across the country toward the end of 2020 and into 2021. The pandemic drove changes in customer behaviour as a result of these travel restrictions, provincial, regional, and/or municipal lockdowns and stay-at-home orders.

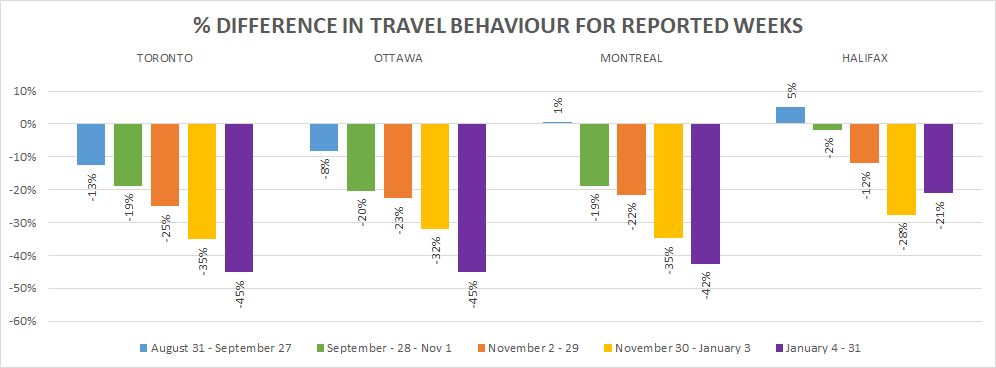

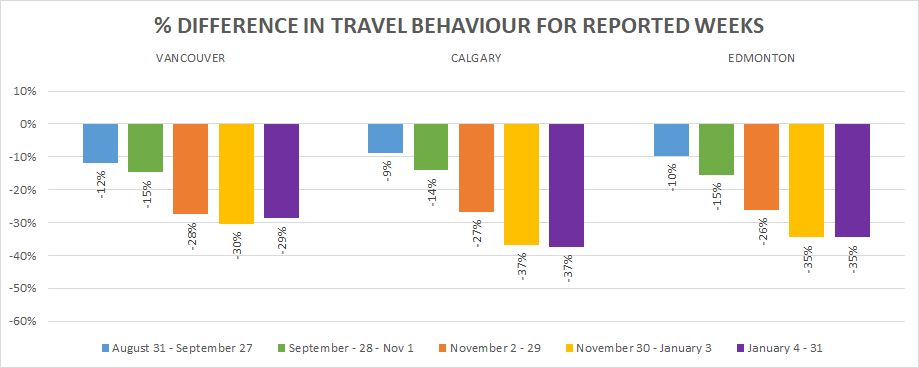

Starting in January 2020 through to March 15, data from nine weeks was used as a baseline to calculate the variance percentage by week, for which the following weeks and months were averaged. The information and visuals within the report illustrate monthly travel behaviour changes from September 2020 through January 2021 within seven major markets across Canada that have been broken down into eastern and western Canada.

The Ontario markets studied, Toronto and Ottawa, show similar declines in the most recent months from December to January 2021, down 10 points to -45 per cent, reflecting the municipal restrictions implemented in late November in the Toronto market and further province-wide restrictions implemented in December. Montreal saw a decline of seven points to -42% as a result of provincial restrictions and curfews, less local, regional, and inter-provincial travel over the holiday season and into the new year. Halifax was not nearly as affected and showed slight increases in travel behaviour by seven points to -21 per cent, for the same period, indicating a significant trend in consumer behaviours following increased cases of COVID-19.

There was little change in travel behaviour in Vancouver over the past few months, with a slight increase of one point to -29 per cent for January. Calgary and Edmonton held steady at -37 per cent and -35 per cent, respectively, during the weeks between December and January. Vancouver showed the most consistent stabilization overall, varying only one to two points during the prior three months. The data suggests within the western Canadian markets, there was less variance between consumer behaviours as a result of lower cases of COVID-19, more lenient public safety guidelines due to lower caseloads. This allowed consumers to return to a more normal day-to-day travel pattern.

Percentage of travel behaviour and new number of cases

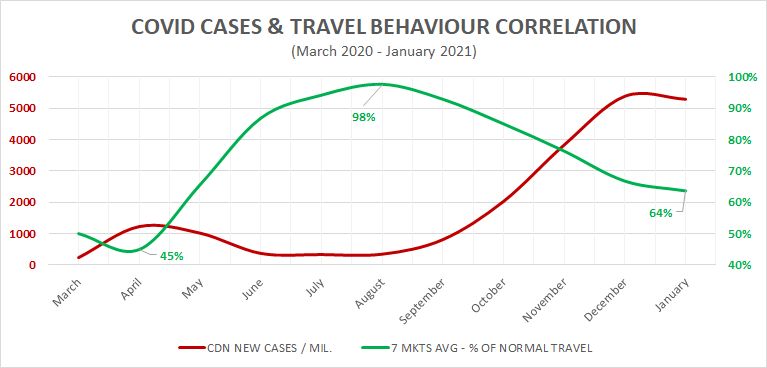

The information below highlights traffic patterns of those who are on the move in correlation to the new COVID-19 cases across Canada. The prior information in this report for eastern and western Canada highlighted a decline in movement.

The graph above illustrates concurrently the number of new COVID-19 cases in Canada and the percentage of travel behaviour from March 2020 to January 2021. The averaged travel behaviour COMMB reported since the beginning of the pandemic across the seven markets studied, and the reported COVID-19 cases per million, illustrate a clear correlation between increases in number of new cases and reduced travel behaviour. Shown in the initial phase (March-April) a steep decline in the percentage of travel patterns due to newly implemented city and/or provincial restrictions. During the spring and summer months, as new cases dropped, travel began to resume to near-normal levels. This positive pattern is something to monitor in the coming months as we manoeuvre the remainder of this second wave of COVID-19 cases and altered travel behaviour.

In preparation for a potential third variant wave, and in support of the upcoming media suite launch later this year, COMMB is ramping up its insights reporting for its members. The new insights are scheduled to launch in Q2 with a solution that will provide increased persistency of information at a more granular level. The solution includes sourcing three years of historical data (2019 baseline, 2020 major COVID-19 impact year, and ongoing throughout 2021), allowing the association to provide compelling insights to support OOH spends during uncertain times.

The report will offer data related to product and road type variance, outdoor versus place-based variance, and much more, across the top 10 markets in Canada (Toronto, Montreal, Vancouver, Calgary, Edmonton, Quebec, Ottawa-Gatineau, St. Catharines-Niagara, Winnipeg, and Hamilton) as well as seven regional markets (Grand Falls-Windsor, Greater Sudbury, Kentville, North Bay, Sault Ste. Marie, St. John’s, and Timmins).