Hot off the press: Wide-format printing trends for businesses to follow

by carly_mchugh | 30 August 2022 3:46 pm

[1]

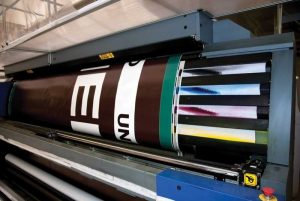

[1]The wide-format printing market has seen significant growth, propelled by the emergence of new, up-and-coming ideas and applications. Photo © Moreno Soppelsa | Dreamstime.com

By Sohil Singh and Aditya Bhardwaj

Recently, the wide-format printing market has seen significant growth, propelled by the emergence of new, up-and-coming ideas and applications. As more industries see the potential of wide-format printing to add unique flair to their projects, its popularity continues to expand beyond just the advertising sphere. Customers are also demanding more customizable solutions amongst digital print offerings, which leaves a whole new space for print service providers (PSPs) to expand and diversify their current portfolios. What follows is a look at today’s trends in digital wide-format printing, as well as how PSPs can take advantage of their growing presence in the market.

Textile printing and soft signage

Texture in visual display has become an attractive alternative for many applications. Lately, it has come forth through fabric display elements, such as soft signage, and has begun to move on to more rigid substrates. Wood-grain texture is gaining more popularity in a variety of substrates, including expanded polyvinyl chloride (PVC) signboard, as it is application-friendly, durable, and visually appealing. It can be imaged using wide-format flatbed printers, equipped to achieve an engraved look, fabricated into structures which double as signage, and endure the elements for many years.

The architecture industry is seeing the benefits of using wide-format printing and varied textured substrates to customize interiors or exteriors in building projects—think rustic lodge interiors with custom-imaged components, such as wayfinding, or structural or signage-related common room elements.

Textile printing has also continued its impact on the visual communications market. Whether it is soft signage, direct-to-garment, direct-to-textile, or anything else in this space, customers are interested in these specialty applications, along with the same quick turnaround times they see in other segments. Even as print providers aim to minimize their turnaround times, they should expect customers to want more custom and personalized options.

Further, trends are emerging across the supply chain to better support direct-to-fabric printing, particularly soft signage. From equipment manufacturers to ink producers and fabric providers, the industry is significantly changing how print buyers look at point-of-purchase (POP) signage. All aspects of textile-based printing—from decor to fashion—will continue to grow exponentially, as these applications create new opportunities to generate revenue for print providers and new product options

for customers.

[2]

[2]Today, print service providers (PSPs) are introducing newer print technologies like ultraviolet (UV) direct-to-substrate printing, as well as expanded digital finishing capabilities. With these comes the potential to explore new revenue streams. Images courtesy Stratojet USA

Leveraging new printing technologies

Today, PSPs are introducing newer print technologies like ultraviolet (UV) direct-to-substrate printing, as well as expanded digital finishing capabilities. As a result, there are now more opportunities than ever to explore both short-run and prototype packaging applications as new potential revenue streams. For many companies producing signage and graphics, this creates an opportunity to offer and deliver the applications various business-to-business customers are already looking to attain. With several other printing technologies, there is an increasing demand for shorter runs and customization in packaging. This serves as a new business opportunity for PSPs who have experience with short runs and tight turnarounds, allowing them to empower both small and established businesses to approach their packaging requirements at a more localized and unique level.

[3]

[3]

Wide-format equipment, coupled with the right finishing capabilities, can provide printers with the opportunity to achieve promotional short-run packaging opportunities. Promotional short-run packaging is a sector that packaging printers are generally not able to compete with, due to their long-run equipment and long lead times. Printers who can position themselves as experts in this area will find new opportunities with local manufacturers and discover this is a growing segment of the packaging market wide-format printers can utilize.

Lastly, as technology and demand move fast in the market, it is anticipated the types and colours of inks available will also continue to evolve. Some companies have already expanded from traditional four-colour printing to include spot colours for everything from metallics to neon. In addition to delivering eye-catching, unique splashes of colour, these new inks will provide opportunities for greater colour fidelity.

[4]

[4]All textile-based printing applications—from decor to fashion—are expected to grow exponentially, as they create new opportunities to generate revenue for print providers and new product options for customers. Photo © Moreno Soppelsa | Dreamstime.com

Adapting and diversifying offerings for printed products

With the popularity of UV-cure equipment and the rise of latex rigid printing, the wide-format market will continue to grow. Enterprising owners and operators are already seeking out new ways to maximize their capital expenditures through an increased number of offerings—often including inventive display graphics solutions. PSPs who are diversifying the type of work they print and the customers they serve will continue to create an impact. Just like any business, the ability to successfully expand one’s specializations will open doors to additional business opportunities.

With so many commercial printers investing in wide-format very rapidly, the market is becoming saturated, leaving much of this apparatus underutilized. This has led to growth in competition and created margin pressures as they try to fill this capacity. Like the traditional commercial market, wide-format is expected to see an increase in consolidation year-over-year. To remain competitive, printers need to identify specialized and/or niche wide-format domains they can reliably “own” in their local market.

As inks evolve and improve, there will also be continued significant development in the diversity of substrates available to print on. In the last five years, there has been remarkable growth in unique products—many of which started off as niche offerings and have grown based on customer demand. PSPs can continue to use these substrates to expand their footprints in the market. The dynamic growth in soft signage is a perfect example of how the marriage of printer manufacturer and substrate manufacturer has helped create an entirely new segment within wide-format, which has had a profound impact on the economics of POP display graphics.

PSPs want solutions which help them meet their evolving needs, such as increased automation in their end-to-end print workflows, verifiable output accuracy which can be proven as consistent over time, and the ability to show print buyers output quality before printing, to differentiate themselves in an already competitive landscape.

There is also a large demand for data, primarily from the production workflow, which is expected to see an increase over the next several years. Having site-wide control using actual data which is not dependent on human input or estimations is becoming a necessity for success in running a productive and efficient print environment. Implementing a solution that can monitor all print jobs in one location and provide production capacity, efficiency, and cost information is just one way PSPs are growing their profitability and reducing waste.

[5]

[5]As quality, speed, and ink performance continue to improve, technological developments in the wide-format market will allow for continued growth. Photo © Dmytro Tolmachov | Dreamstime.com

Conclusion

Based on the changes in wide-format printing over the last 10 years, the market will continue growing, with PSPs diversifying and printing on a greater number of substrates to meet customer demand. Customization and localization of marketing campaigns, which have proven themselves successful, will become the standard for all campaigns. This will continue to aid in the growth of digital printing in the wide-format market. Further, as print quality continues to improve, print speeds get faster, and PSPs require optimum ink performance, technological developments in the wide-format market will also allow for continued growth.

There will also be a shift towards print and fabrication. This includes multi-substrate displays or signage with ability for the printer to provide the fabricated piece. For example, a PSP could build a lightbox and print the fabric the retailer would use for the display, which would be easy to change out. Being a fabricator means they can “own” the annuity of replacing a printed sign, which usually changes with each season or promotion. The long-term value lies in the ability to provide this service to customers.

Smart printers who have invested in wide-format will begin to find specialized niches they can “own” in their market. From product niches like fabric or vehicle wraps to industry niches like commercial real estate or promotional packaging, specialization is the best way to ensure success in the wide-format business.

Sohil Singh is vice-president of StratoJet USA. Singh has been in the wide-format industry for more than 11 years, starting work with building and developing printers since 2008. With the goal and vision to make best-in-class print solutions using the perfect combination of technology and simplicity, Singh helps businesses become more efficient on print applications and production.

Aditya Bhardwaj is a marketing assistant with StratoJet USA. Bhardwaj is passionate about large-format print technology, as well as building a creative vision to educate the new, upcoming generation on large- and wide-format printing using the company’s latest technological innovations.

- [Image]: https://www.signmedia.ca/wp-content/uploads/2022/12/dreamstime_l_11857083.jpg

- [Image]: https://www.signmedia.ca/wp-content/uploads/2022/12/SHARK-EFB-SERIES.jpg

- [Image]: https://www.signmedia.ca/wp-content/uploads/2022/12/Falcon-XL-Series.jpg

- [Image]: https://www.signmedia.ca/wp-content/uploads/2022/12/dreamstime_m_23922466.jpg

- [Image]: https://www.signmedia.ca/wp-content/uploads/2022/12/dreamstime_m_153146155.jpg

Source URL: https://www.signmedia.ca/hot-off-the-press-wide-format-printing-trends/