The future market

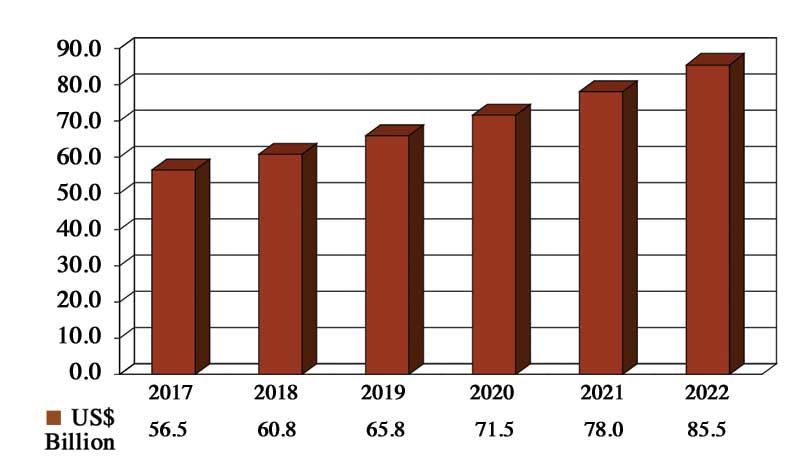

The global consumption value of LED-based signage and display systems is expected to grow at an annual rate of 8.6 per cent, from US$56.5 billion in 2017 to US$85.5 billion in 2022 (see Figure 1). This data refers to the consumption for each particular year; it is not cumulative.

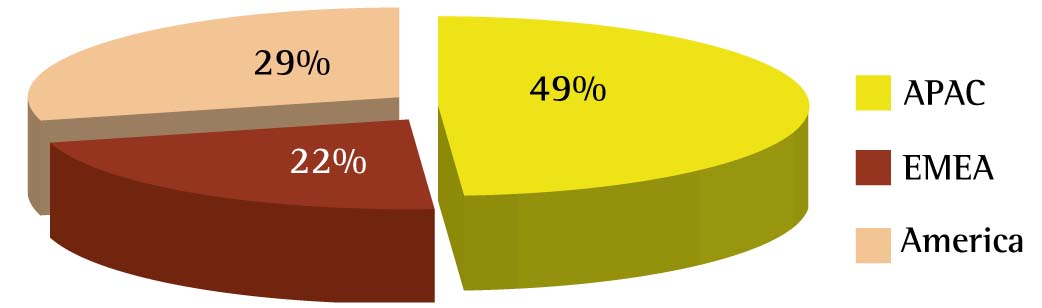

In terms of regional market share, Asia-Pacific (APAC) holds the lead in all product, system and application categories (see Figure 2). Even though the average selling prices in this region are lower than those in Europe, the Middle East and Africa (EMEA) and North America, the sheer quantity of systems purchased within APAC places the region in the top position in terms of value.

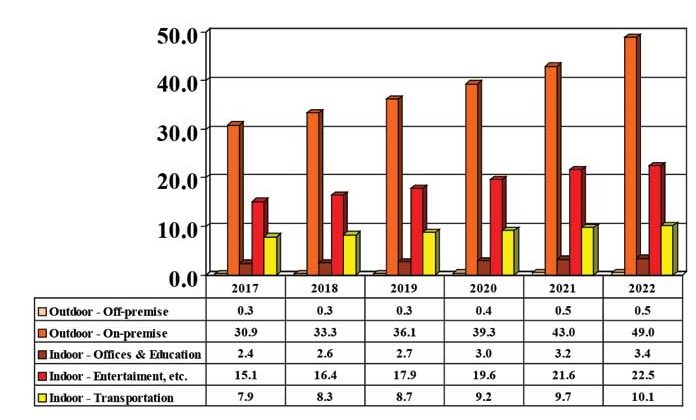

Among applications for LEDs in signage and display systems, outdoor on-premise signs are in the lead, with their worldwide value forecast to increase from US$30.9 billion in 2017 to US$49 billion in 2022 (see Figure 3). Most indoor applications are for entertainment, sports, food-service, hospitality and retail venues, followed by transportation facilities, office buildings and schools.

Some applications, of course, represent a combination of these categories. One notable example is the LED-based video wall that was recently installed in the the main lobby of the new global Ultimate Fighting Championship (UFC) corporate campus in Las Vegas, Nev.

The mixed martial arts (MMA) organization wanted every part of the facility—which includes a major new training centre—to amplify its brand image as a world-class corporation. For the lobby, UFC turned to National Technology Associates (NTA), an audiovisual (AV) integration firm, which specified a 3.8 x 6-m (12.5 x 20-ft) video wall, using NanoLumens’ Engage series of LEDs, which offer a pixel pitch of 2.5 mm (0.1 in.) for up-close indoor viewing. As the wall plays live feeds, splits into multiple screens and streams high-quality sound with its built-in audio system, visual content is displayed at a resolution of 2,688 x 1,536 pixels, going beyond high-definition (HD) video.

New technologies will also shape how and where LEDs are purchased and used. In June 2017, for example, LG Electronics announced a 0.8-mm (0.03-in.) thick, flexible, transparent LED display that can reportedly be installed on any existing glass surface with a self-adhesive film, allowing dynamic content to be integrated more seamlessly with its surrounding environment.

“We’re tapping into a new product segment that can create visual ambience in new ways in retail settings and public spaces,” says Dan Smith, LG’s vice-president (VP)

of business development in the U.S.

Each 480 x 480-mm (19 x 19-in.) panel contains 256 LED-based pixels, provides 1,000 nits of brightness and supports both standard and irregular aspect ratios for a wider range of display options for flat and curved surfaces. As the panels can be connected with a bezel kit, with up to 24 supported through a daisy chain from a main unit controller, systems can be scaled to fit a variety of installation locations, ranging from storefront windows to safety barriers in mass-transit facilities to glass elevator shafts in large public areas.

With this and other ongoing developments in LED technology, almost any physical space can now be converted into a large-scale, state-of-the-art display. Hence, the value of the overall market will only increase further with the scale of future implementations.

Stephen Montgomery is president of ElectroniCast Consultants, which forecasts technology trends in the LED, photonics and fibre optic markets. For more information, visit www.electronicast.com.