Illumination: Forecasting the market for LED signage and displays

by all | 13 December 2017 11:35 am

[1]

[1]Photos courtesy ElectroniCast Consultants

By Stephen Montgomery

Market research shows the worldwide consumption value for complete signage and display systems based on light-emitting diodes (LEDs) reached new heights in 2017 at an estimated US$56.5 billion. This overall figure, however, does not convey the many different ways LEDs are used in professional displays today.

Market forecasts are segmented based on specific applications, including on-premise and off-premise outdoor displays (e.g. roadway digital billboards) and indoor screens for airports, bus and train terminals, shopping centres, restaurants, hotels, sports facilities, entertainment venues, office buildings and educational institutions. One of the most notable trends, given the categorization of such segments, is the increasing migration of large-format LED arrays from their traditional outdoor locations to open indoor spaces, as well.

Categorized by purpose

With LED cluster displays, multiple LEDs are mounted on boards to form tile modules for digital signage applications. This category includes not only video walls and digital billboards, but also flexible LED-based displays, where even a curtain or drapery can become a dynamic screen.

While liquid crystal displays (LCDs) backlit by LEDs are also commonly used for digital signage applications, they are quantified separately, as their LEDs serve a different purpose; rather than display content themselves, they illuminate the LCDs, which display the content.

LEDs are also commonly used to illuminate conventional or traditional sign media by day and night, including static billboards, paper- or canvas-based graphics, channel letters and sign boxes. In this context, their role is comparable to that of neon, fluorescent and electroluminescent (EL) illumination before them.

While neon and fluorescent lighting are still fairly commonly used today and can prove effective for many years, LEDs have provided a strong alternative with their energy efficiency, solid-state construction and cooler operation. Indeed, their rise may signal the eventual demise of older sign illumination technologies.

Even the latest high-brightness LEDs (HB-LEDs) are low-voltage and operate with minimal running costs, allowing signs to be both bright and energy-efficient. Further, LEDs are highly durable, offering greater longevity than other traditional forms of sign lighting and reducing the frequency and costs of maintenance.

[2]

[2]DOOH advertising is leading growth of the overall OOH industry.

Sign lighting techniques

LED illumination can be implemented with a variety of techniques, including back, front, edge and halo lighting.

Metal and acrylic letters can be front- or backlit, respectively, as sign faces or halo-illuminated for a subtler, esthetically pleasing effect. Acrylic panels can be edge-lit with LEDs to serve as ‘light sheets’ or collectively as ‘light walls’ or integrated into aluminum frames to serve as ultra-thin lightboxes. More traditional aluminum lightboxes, which have been used for decades and remain very common today, can also be illuminated with LEDs from within.

With these common signage applications in mind, different LED products have been specially developed for optimal lighting of channel letters and lightboxes, to name a few. By packaging ultra-high-intensity LED semiconductor chips, uniform illumination can be achieved across a wide range of angles.

By way of example, most 203-mm (8-in.) stroke channel letters can be illuminated by using just a single row of LEDs, without creating visible ‘hot spots.’ These systems can also illuminate channel letters with depths as little as 64 mm (2.5 in.).

As mentioned, LEDs can be used to create flexible lighting systems. With a bending radius of less than 1.3 mm (0.05 in.) and an anticipated 500,000-plus bending cycle ‘lifetime,’ they can be flexed at almost any angle, follow the tightest contours and be installed in one continuous strip, with only one or two connecters needed per channel letter.

[3]

[3]Digital billboard, like this one in Vaughan, Ont., typically display a series of static ads, with transitions every four to 10 seconds.

Part of the digital signage landscape

Digital signage is not a specific technology, but rather a medium, defined by the ability to display dynamic content, including video, real-time streaming information and animation.

A digital signage network comprises a variety of hardware components, which include personal computers (PCs), media players running an operating system (OS) or system-on-a-chip (SoC) interfaces and, of course, the display devices themselves, which can be LED arrays, LCDs or digital projectors. Specialized variations include touch-interactive screens and, most recently, organic LED (OLED) displays, which can offer ‘mirror’ or transparent effects.

These components rely on communications links between transmitters and receivers, from wireless links for short distances to copper wire for medium lengths to fibre optics for distances up to 20 km (12 mi). Another key piece to the puzzle is the content management system (CMS) software.

[4]

[4]Among applications for LEDs in signage and display systems, outdoor on-premise signs lead the market.

Leading OOH growth

One area where LED-based digital signage is experiencing significant growth is out-of-home (OOH) advertising, which reaches consumers—as its name suggests—while they are outside their homes. There are a range of OOH formats, including billboards, street posters and transit ads. The revenue from these ads continues to rise overall, thanks in large part to digital OOH (DOOH) media.

“Digital continues to lead OOH growth across all categories and is particularly strong in the transit and street furniture categories,” says Stephen Freitas, chief marketing officer (CMO) for the Outdoor Advertising Association of America (OAAA). “These DOOH formats have a particularly high propensity for driving consumer engagement on mobile devices, too, and that is part of the reason for the significant investments being made by some of the world’s most innovative technology companies.”

DOOH content is also distributed across place-based digital signage networks, where operators can switch between facility-specific information, local event listings, social media feeds and third-party advertising.

Digital billboards typically display a series of static ads, with updates every four to 10 seconds, depending on the applicable municipal regulations. OAAA’s own code of industry practices requires them to comply with brightness standards and not feature animation, flashing lights, scrolling or full-motion video. Rules may vary for on- and off-premise LED signs, based on various markets’ local zoning regulations.

The aforementioned street furniture brings smaller-format LED-based digital signs to both drivers’ and pedestrians’ eye level, where they are most likely to influence consumers while they travel through public spaces and city centres.

[5]

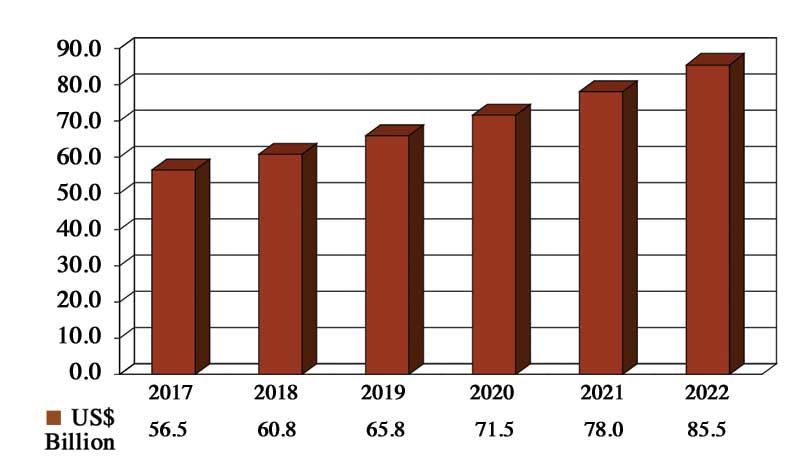

[5]Figure 1

The future market

The global consumption value of LED-based signage and display systems is expected to grow at an annual rate of 8.6 per cent, from US$56.5 billion in 2017 to US$85.5 billion in 2022 (see Figure 1). This data refers to the consumption for each particular year; it is not cumulative.

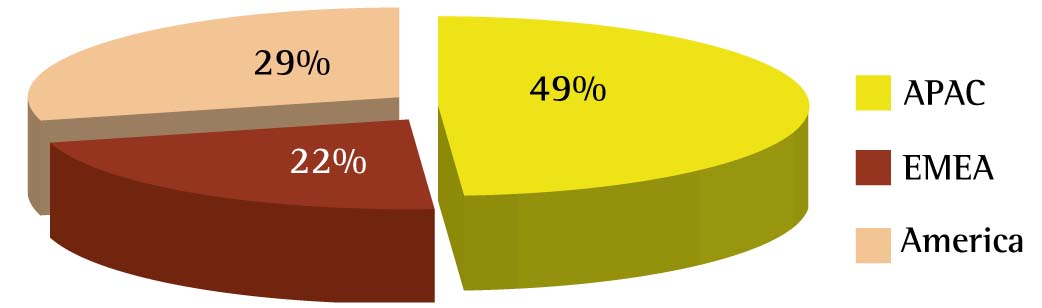

In terms of regional market share, Asia-Pacific (APAC) holds the lead in all product, system and application categories (see Figure 2). Even though the average selling prices in this region are lower than those in Europe, the Middle East and Africa (EMEA) and North America, the sheer quantity of systems purchased within APAC places the region in the top position in terms of value.

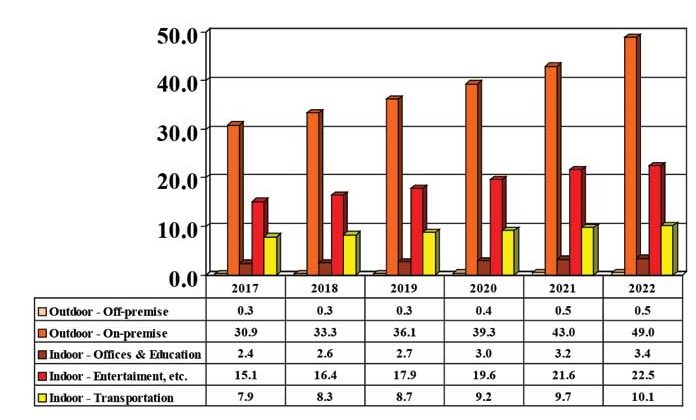

Among applications for LEDs in signage and display systems, outdoor on-premise signs are in the lead, with their worldwide value forecast to increase from US$30.9 billion in 2017 to US$49 billion in 2022 (see Figure 3). Most indoor applications are for entertainment, sports, food-service, hospitality and retail venues, followed by transportation facilities, office buildings and schools.

Some applications, of course, represent a combination of these categories. One notable example is the LED-based video wall that was recently installed in the the main lobby of the new global Ultimate Fighting Championship (UFC) corporate campus in Las Vegas, Nev.

[6]

[6]Figure 2

The mixed martial arts (MMA) organization wanted every part of the facility—which includes a major new training centre—to amplify its brand image as a world-class corporation. For the lobby, UFC turned to National Technology Associates (NTA), an audiovisual (AV) integration firm, which specified a 3.8 x 6-m (12.5 x 20-ft) video wall, using NanoLumens’ Engage series of LEDs, which offer a pixel pitch of 2.5 mm (0.1 in.) for up-close indoor viewing. As the wall plays live feeds, splits into multiple screens and streams high-quality sound with its built-in audio system, visual content is displayed at a resolution of 2,688 x 1,536 pixels, going beyond high-definition (HD) video.

New technologies will also shape how and where LEDs are purchased and used. In June 2017, for example, LG Electronics announced a 0.8-mm (0.03-in.) thick, flexible, transparent LED display that can reportedly be installed on any existing glass surface with a self-adhesive film, allowing dynamic content to be integrated more seamlessly with its surrounding environment.

[7]

[7]Figure 3

“We’re tapping into a new product segment that can create visual ambience in new ways in retail settings and public spaces,” says Dan Smith, LG’s vice-president (VP)

of business development in the U.S.

Each 480 x 480-mm (19 x 19-in.) panel contains 256 LED-based pixels, provides 1,000 nits of brightness and supports both standard and irregular aspect ratios for a wider range of display options for flat and curved surfaces. As the panels can be connected with a bezel kit, with up to 24 supported through a daisy chain from a main unit controller, systems can be scaled to fit a variety of installation locations, ranging from storefront windows to safety barriers in mass-transit facilities to glass elevator shafts in large public areas.

With this and other ongoing developments in LED technology, almost any physical space can now be converted into a large-scale, state-of-the-art display. Hence, the value of the overall market will only increase further with the scale of future implementations.

Stephen Montgomery is president of ElectroniCast Consultants, which forecasts technology trends in the LED, photonics and fibre optic markets. For more information, visit www.electronicast.com[8].

- [Image]: https://www.signmedia.ca/wp-content/uploads/2017/12/Azalea-Shopping-Center_DSF-6MN-WN-MC-240x192_24.jpg

- [Image]: https://www.signmedia.ca/wp-content/uploads/2017/12/Park-Outdoor_Syracuse-NY-alt.jpg

- [Image]: https://www.signmedia.ca/wp-content/uploads/2017/12/RCC-Media-e1513181934246.jpg

- [Image]: https://www.signmedia.ca/wp-content/uploads/2017/12/Azalea-Shopping-Center_DSF-6MN-WN-MC-240x192_18-e1513182049556.jpg

- [Image]: https://www.signmedia.ca/wp-content/uploads/2017/12/Figure1-LED.jpg

- [Image]: https://www.signmedia.ca/wp-content/uploads/2017/12/FIG2.jpg

- [Image]: https://www.signmedia.ca/wp-content/uploads/2017/12/Figure3-LED-e1513182783725.jpg

- www.electronicast.com: http://www.electronicast.com

Source URL: https://www.signmedia.ca/illumination-forecasting-market-led-signage-displays/