Illumination: Market trends for LED signage and displays

by all | 9 December 2015 10:41 am

[1]

[1]Photo courtesy Pride Signs

By Stephen Montgomery

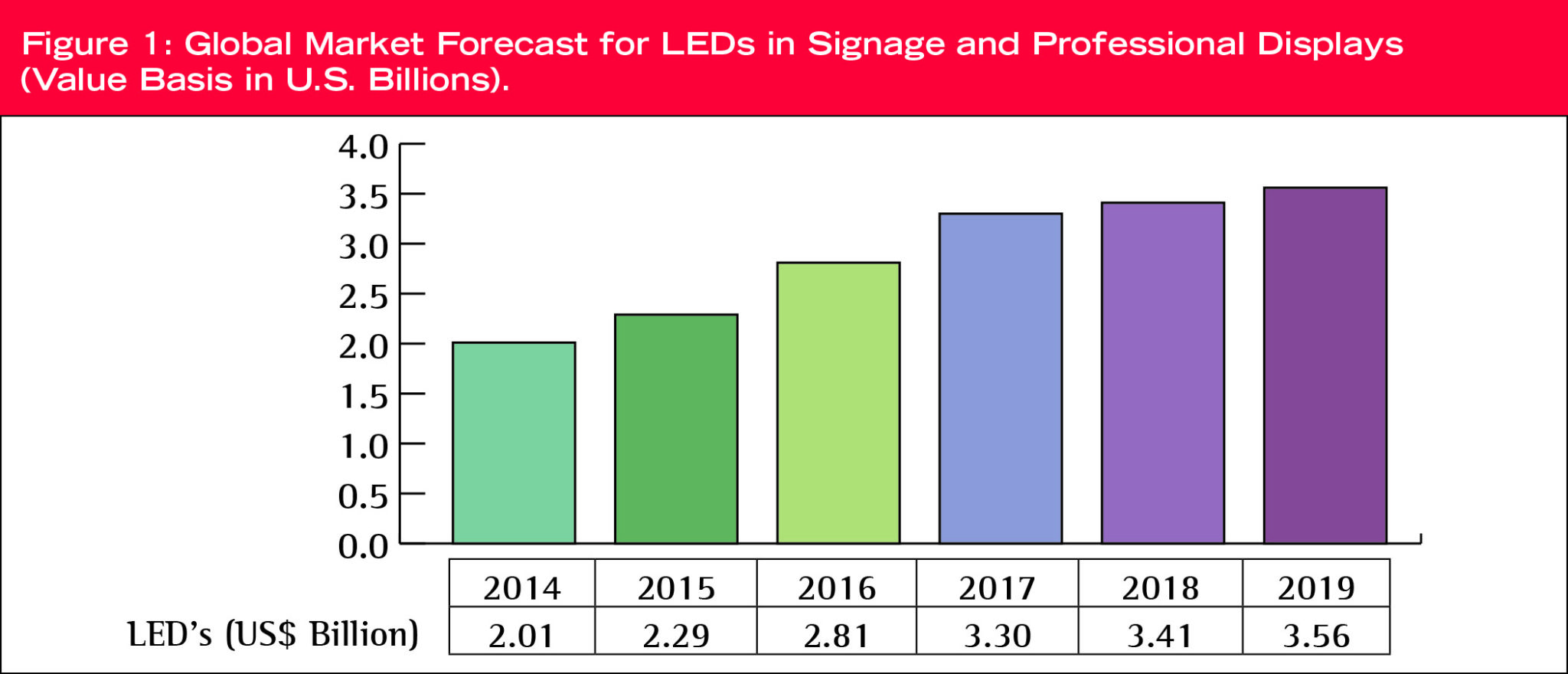

Market research shows the value of light-emitting diodes (LEDs) used in signage and professional displays around the world reached nearly $2.3 billion U.S. in 2015, up from just over $2 billion in 2014, and this market is forecast to grow to nearly $3.6 billion in 2019. (And these forecasts refer to consumption within a particular calendar year; they do not represent cumulative data.)

The sheer growth of the LED industry, however, is only part of the story, behind which is the customization of various LED products for specific purposes.

Packaging LEDs

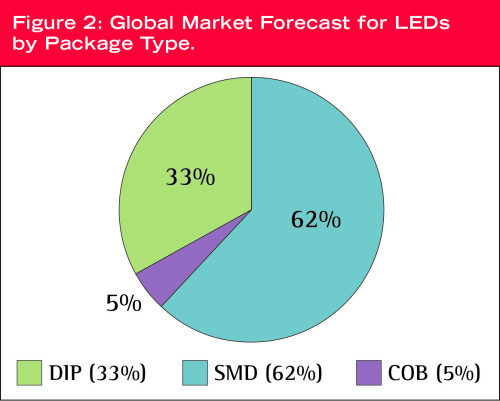

LEDs can be segmented by the following package types: dual in-line package (DIP), surface-mount diode (SMD) and chip-on-board (COB). As well, how these packages are used in the sign and display industry can be segmented into the following applications: digital signage, backlit channel letters/boxes and backlit professional-grade liquid crystal displays (LCDs).

The consumption value of DIP LEDs is forecast to increase by more than 20 per cent each year, SMC LEDs are expected to see negative growth and, most notably, COB and multiple-COB (MCOB) LEDs are set to grow by nearly 180 per cent per year through 2019.

The use of COB and MCOB LEDs in signage and display applications is relatively new. They are typically specified for general illumination purposes instead—and, indeed, many ongoing evaluations of LEDs focus on their potential to displace traditional light bulbs in architectural applications—but as their true value proposition is recognized, they are also finding their way into channel letters, sign panels, backlit LCDs and box signs. There are also research and development (R&D) efforts aiming to introduce them into digital signage display applications.

The worldwide consumption of DIP LEDs was expected to reach nearly $760 million U.S. in 2015. All DIPs are single-colour, but when they are used in digital boards, they are often placed in ‘blocks,’ such that each block accommodates two or three colours.

SMD LEDs carry a much higher selling price than DIPs. In 2015, they held a leadership position in the global marketplace with 62 per cent of consumption value, whereas DIPs were dominant in terms of volume (quantity). It is important to note both SMD and COB LEDs are often multiple-chip products, bringing red, green and blue (RGB) together. Market research counts each multiple-chip product as one LED, not three.

Options and advantages

LED lighting offers an array of options and advantages for illuminating signs. The latest high-brightness LEDs (HB-LEDs) are low-voltage and energy-efficient; they can operate with low running costs. LEDs also offer increased longevity compared to traditional forms of sign illumination, so they can reduce maintenance costs.

[2]

[2]Figures courtesy ElectroniCast Consultants

LEDs can be used for back- or front-lighting metallic or acrylic sign letters for bright faces or halo-illuminate them for a subtler effect. They can also be used to edge-light acrylic panels, which in turn can be used independently as light sheets and walls or integrated into aluminum frames to create ultra-thin lightboxes.

Today, LEDs are installed in everything from dynamic building façades, gigantic outdoor video screens, digital billboards and stadium scoreboards to indoor retail displays, menu boards, destination signs in transit vehicles and backlit LCDs. The following are just a few examples of how they are being used today throughout the sign and display industry.

Channel letters, lightboxes and backlighting

There are still many ways to light a sign by day and night, including LEDs, neon, fluorescent and electroluminescent (EL) systems. There are also different techniques for illuminating them, as mentioned, including back, edge, front and halo lighting.

[3]While fluorescent and neon lighting are still used in the sign industry today, LEDs have provided a strong alternative. Indeed, they may yet signal the demise of older technologies.

[3]While fluorescent and neon lighting are still used in the sign industry today, LEDs have provided a strong alternative. Indeed, they may yet signal the demise of older technologies.

Traditional aluminum lightboxes have been effective for decades and remain very common today. Typically 203 mm (8 in.) thick, they have a series of fluorescent tubes mounted inside to illuminate graphics applied to acrylic faces on one or both sides. By today’s standards, however, this traditional method of lightbox fabrication leads to excessive consumption of power.

A typical large-format lightbox, for example, at 6 x 3 m (20 x 10 ft) in size, will require 45 58-W fluorescent tubes for effective illumination. Even if it is operated for only 12 hours a day, it will use approximately 12,000 kW of power per year, for an electricity bill in excess of $1,000 U.S. per year.

Maintenance is another problematic issue for this type of sign. With just one faulty fluorescent tube, the sign presents its graphics poorly; and with 45 or more tubes mounted within a single sign, the likelihood of a fault at any given time is rather high. Flickering and/or broken tubes quickly represent a significant ongoing cost in terms of maintenance.

As a result, it is common to see these signs showing dull patches or shadows across their surface. This flawed presentation will have a negative impact on consumers’ perception of the advertised brand. It simply does not look professional, nor is it bright enough to capture the same level of attention as envisioned at the sign’s inception.

In addition to the previously mentioned benefits of dramatic reductions in energy consumption costs and maintenance needs, LEDs can help save space with thinner lightboxes, provide more even illumination and meet regulatory requirements for sustainability.

LED-backlit LCDs

Much as LED-backlit LCDs have been adopted as consumer TVs, so too are commercial-grade models used exclusively for professional display and digital signage purposes. Software and external hardware are usually added to the system to provide video and sometimes audio content.

Large, industrial LED-backlit LCDs have become common at public facilities like airports and train stations—both indoors and outdoors—to quickly deliver up-to-date information to passengers and passersby. Generally, they operate 24-7 and are wired to a network of other displays.

[4]

[4]LEDs can back- or front-light letters or halo-illuminate them for a subtler effect. Photo courtesy Pride Signs

LED screens

LED-based digital signage is primarily known as an outdoor medium, to be viewed from farther distances than LCDs, but it also has indoor applications. In particular, many indoor video walls are now large-scale LED arrays, rather than matrices of thin-bezel LCDs.

Many of these applications are driven by digital out-of-home (DOOH) advertising, which can bring in ongoing revenue to a shopping mall or other venue. At the touch of a button, display operators can switch between facility information, ads, social media, event listings and other content.

“Higher-resolution outdoor displays are in demand,” says Jeff Rushton, president and CEO of Media Resources International in Oakville, Ont., “but indoor ultra-high-definition (UHD) video walls are also a major trend. They are found in train stations, airports, shopping malls and even tunnels.”

Of course, large LED-based displays are well-established as scoreboards in sport venues. Today’s go beyond traditional scoreboard content with full video and sophisticated on-command programming software.

Digital billboards, which also use LEDs, are becoming increasingly common. Of the approximately 450,000 billboards across the U.S., for example, about 0.55 per cent have been converted from static to digital. One of the main reasons is they increase potential revenue for billboard operators by increasing the number of advertisers who can pay to display their messages at any given location.

[5]

[5]Off-premise digital billboards, which have become increasingly common, typically display a series of still images. Photo courtesy Media Resources International

Depending on local regulations, digital billboards typically display a static image for four to 10 seconds before switching to another. In the U.S., the Outdoor Advertising Association of America (OAAA) has established a code of industry practices, including brightness standards and restrictions against animation, flashing lights, scrolling and full-motion video. In Canada, meanwhile, municipal bylaws continue to be developed to regulate the increasingly common technology.

Digital billboards displaying multiple advertisers’ messages are typically located off-premise—i.e. not on an advertiser’s own property, but rather some distance away, usually a roadside location with high visibility to traffic. Operators then sell space on the billboards to third-party advertisers, such as banks, restaurants, retailers, automotive dealerships, hotels, insurance providers and real estate agents.

An on-premise digital billboard, on the other hand, is typically smaller and installed on the property of the business it exclusively promotes. It may be mounted atop a building, on posts or within a monument. Unlike off-premise billboards, this type of sign may feature animation, scrolling or full-motion video, depending on local zoning regulations.

Another trend has been the integration of LED-based digital signage into custom-designed on-premise structures, including parts of buildings. An LED array can even be applied across a curved, dimensional surface.

“It is important to use a communication network to monitor and diagnose any issues with the entire signage infrastructure, including the LED modules, cables, etc.,” says Rushton. “With their redundancies, network systems have taught us some helpful techniques for maximizing uptime.”

A structure might even combine LED-based digital signage with LED-illuminated static signage, as with the Improve Canada sign built by Pride Signs in Cambridge, Ont., with LEDs arranged by Media Resources, which recently won an award in the Sign Association of Canada’s (SAC’s) annual competition.

In all of these cases, outdoor LED boards are a powerful tool for clear communication of the right message at the right time to the right audience. Copy can be changed, brand marketing can be aligned with consumer traffic patterns and vital messages—like public emergency announcements—can be highly useful for travellers and the community.

Stephen Montgomery is president of international business expansion for ElectroniCast Consultants, which forecasts trends in LED illumination and communication networks. For more information, visit www.electronicast.com[6].

- [Image]: http://www.signmedia.ca/wp-content/uploads/2015/12/186.jpg

- [Image]: http://www.signmedia.ca/wp-content/uploads/2015/12/FIgure-1-2.jpg

- [Image]: http://www.signmedia.ca/wp-content/uploads/2015/12/Figure-2-2.jpg

- [Image]: http://www.signmedia.ca/wp-content/uploads/2015/12/Museum2.jpg

- [Image]: http://www.signmedia.ca/wp-content/uploads/2015/12/Ceislok-V2-LED-10x35.jpg

- www.electronicast.com: http://www.electronicast.com

Source URL: https://www.signmedia.ca/illumination-market-trends-for-led-signage-and-displays/