Illumination: Market trends for LED signage and professional displays

by all | 9 December 2016 10:30 am

Photo courtesy Sport Chek

By Stephen Montgomery

The global market for the use of light-emitting diodes (LEDs) in signage and other professional displays is vast, as the application category covers a wide range of stationary and mobile (i.e. vehicle-based) signs and displays, including large outdoor video screens, scoreboards and other sports stadium displays, digital billboards, small indoor retail displays, taxi-top signs, destination signs on mass-transit vehicles, channel letters, lightboxes, backlit liquid crystal displays (LCDs), signals and many more.

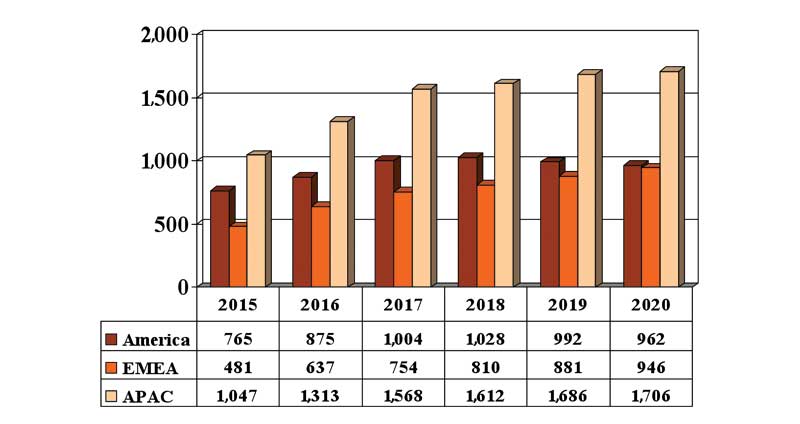

In 2015, the worldwide consumption value of packaged LEDs used in signage and professional displays reached nearly $2.3 billion U.S. By the year 2020, this value is forecast to top $3.6 billion U.S. (i.e. as per market forecast data referring to consumption within each particular calendar year, such that the data is not cumulative).

Within the Americas, the consumption value reached $765 million U.S. in 2015 and is expected to expand at an average annual rate of 4.7 per cent, peaking in 2018 at more than $1 billion U.S. before reducing slightly to $962 million U.S. in 2020 (see Figure 1).

The Asia-Pacific (APAC) region, meanwhile, is forecast to maintain its leadership position in relative market share throughout the same period, reaching $1.7 billion U.S. in 2020, at which point it will represent 47 per cent of global consumption value.

The Europe, Middle East and Africa (EMEA) region held a 21 per cent share of global consumption value in 2015 and is expected to experience an average annual growth rate of 14.5 per cent.

Packaged for use

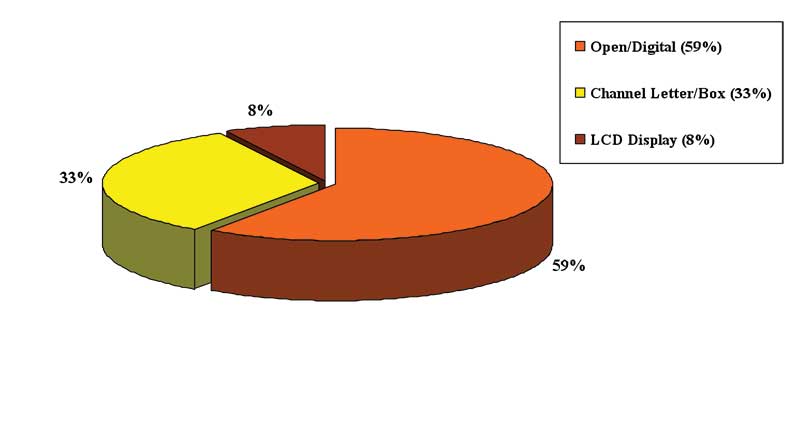

In the tracking of this market, LEDs are segmented into several package types, including dual in-line package (DIP), surface-mount diode (SMC), chip-on-board (COB) and multiple-COB (MCOB) LED products. Further, the use of each package type is segmented into different types of signs and displays, including digital signage, open-face displays, backlit channel letters, sign boxes and backlit professional LCD screens (see Figure 2).

The consumption value for DIP LEDs, for example, is forecast to increase in value by an average of 13 per cent per year. SMD LEDs, however, are expected to see negative growth, depending on the particular display type and the region, while COB and MCOB LEDs are set for strong increases in value of 71 per cent per year for the period from 2015 to 2020.

The use of both COB and MCOB LEDs in signage and display applications is relatively new. They have typically been considered a technology for general illumination applications, but they are now also finding their way into channel letters, sign panels and boxes, backlighting units (BLUs) for LCD screens and, for that matter, further research and development (R&D) efforts for the introduction of new products for signage and display applications.

The ‘finest’ LED display to date, launched in September 2016, delivers a pixel pitch of just 0.9 mm (0.035 in.).

Photo courtesy Leyard

Classifying signs

The main purpose of all signs and displays is to communicate and convey information, such that the receiver may make cognitive decisions based on the information provided. They are similar to but distinct from labels, which convey information about a particular product.

Signs may also be classified according to the following functions:

- Information—Many signs display information about services and facilities, such as directory listings or instructions.

- Direction—Wayfinding systems, comprising such elements as directional arrows and sign posts, direct people to the various service locations, facilities, functional spaces and key areas.

- Identification—Upon arrival, this type of sign indicates immediately available services and facilities. Examples include room names and numbers, restroom signs, as well as various floor designations.

- Safety and Regulatory—Warning signs, traffic signs and exit signs are all examples of signs that provide warnings or safety instructions. Others convey specific rules and regulations.

Illumination options

LEDs offer a vast array of options for illuminating signs. The latest high-brightness LEDs (HB-LEDs) are low-voltage, low-heat and operate with low running costs, allowing signs to be both brilliantly bright and energy-efficient. Further, they provide increased longevity compared to traditional forms of lighting, reducing the maintenance costs that are associated with signs.

LEDs can be used for rear, halo or front lighting of metallic or acrylic channel letters, with many subtle, esthetically pleasing effects possible. They can also edge-light acrylic panels, which can be used independently as light sheets or collectively to form light walls. Another option is to integrate LEDs into aluminum frames to produce ultra-thin lightboxes.

Indicating destinations

The installation of LED-based signs in or on public transportation vehicles, by way of example, remains a stable market. These include destination signs or indicators mounted on the front, side or back of

a bus, streetcar/tram or light-rail transit (LRT) vehicle, which display the route number, name and/or destination.

Today’s destination indicator signs include a mix of flip-disc, liquid crystal display (LCD) and LED panels that can be animated to display text and, in some cases, colours. They can indicate a potentially unlimited number of routes, so long as they are programmed to do so via the vehicle’s on-board computer. Some of these signs also change as the vehicle moves along its route with the help of the Global Positioning System (GPS) and a centralized vehicle-tracking system.

In the U.S., the Americans with Disabilities Act specifies certain criteria for transit vehicles’ destination signs, including maximum and minimum character height-to-width ratios and contrast levels, to ensure the signs are sufficiently readable to visually impaired persons. These criteria have informed the designs of LED-based transit signs in other countries, too.

LED-based digital signage

Digital signage uses content management system (CMS) software and media distribution technology—whether based on a local personal computer (PC) or server or hosted by a regional or national provider—to display information on a dynamic screen, which may be LED-based.

This application category goes beyond the aforementioned LED-based destination signs on public transit vehicles to include large digital billboards along roadways, arrival and departure signs at airports and railway stations, time-and-temperature signs, open/closed signs and super-large scoreboards at sports stadiums, among other possibilities.

While many ongoing evaluations of LEDs have focused on their potential to displace traditional lighting in general architectural illumination applications in the future, there is a need to overcome some misconceptions about their true value proposition. Many implementations of LEDs are indeed intended to replace existing light fixtures, but others are using LEDs as an entirely new model for ‘digital light,’ exploiting the capability to control LEDs dynamically so as to display information. They have already become a mainstay technology for the digital signage sector.

Dynamic displays in high-traffic areas are changing the face of public spaces and there are still further possibilities for digital signage everywhere. LED arrays can be used for informational messaging, advertising, entertainment and architectural ambience, transforming the experiences of shopping, working and socializing.

Digital billboards, comprising arrays of LEDs, are becoming more common across Canada.

Photo courtesy Outfront Media

Pixel-pitch breakthroughs

One of the core specifications for determining

the clarity, effectiveness and cost of an LED-based digital sign is pixel pitch. Also known as dot pitch, this is the measurement of the spacing between clusters of LEDs within an array.

In September 2016, for example, Leyard launched the industry’s finest pixel-pitch LED display to date, delivering a pixel pitch of just 0.9 mm (0.035 in.) for video wall applications. By breaking the 1-mm (0.04-in.) barrier, the display achieves unprecedented resolution for an LED array, offering clear viewing even at close distances of 3 m (9.8 ft) or less. Earlier Leyard video walls ranged in pixel pitch from 1.2 to 2.5 mm (0.047 to 0.098 in.).

Further, LED arrays are now being made available in flat-panel designs and the 16:9 aspect ratio that meet popular high-definition (HD) standards, making them more directly competitive with LCDs in the digital signage sector. They are similarly engineered as factory-aligned, self-contained units with standard HD Multimedia Interface (HDMI) inputs and looping, along with optional redundant configurations, reducing the cost and time required for installation. Larger units mean fewer displays are needed to create a video wall, reducing the potential number of points requiring service and maintenance in the long term.

The advantage of curves

That said, there is also a major trend involving the custom design and engineering of LED-based displays, e.g. incorporating curves and slim profiles to accommodate unique installation settings in different types of buildings or other structures. Manufacturers like NanoLumens, for example, can fit their LED displays to the needs of existing architecture.

An additional advantage of curved digital signage is the ability to catch passersby’s attention. When it comes to connecting with an audience in today’s relatively saturated market, straight planes are not always the best choice. The human eye is naturally drawn to sleek curves, so even if a custom-shaped LED display only offers a pixel pitch between 3 and 9 mm (0.12 and 0.35 in.), it can convey an enhanced experience for the viewer.

Where LEDs meet LCDs

As mentioned, LEDs are also used as BLUs for LCDs in the digital signage marketplace. So,

as LCDs continue to find their way into mass transit vehicles, airports, train and bus stations, retail stores and other locations, the LED market grows at the same time.

LCDs have long overtaken plasma display screens, where there was a much higher chance of image retention and ‘burn-in.’ This is an especially important issue for digital signage, since the text and image templates used for messaging applications are often stagnant. Another concern with plasma screens, as digital signage applications made their way to outdoor installations and other bright locations, was how they could not prevent glare as well as LCDs could.

When backlighting LCDs, there are several significant advantages offered by LEDs over cold cathode fluorescent lamps (CCFLs), including power savings of up to 50 per cent, a superior contrast ratio, broader colour gamut and the elimination of motion blurring.

There are two main configurations for LED BLUs in commercial-grade LCDs—edge-lighting and direct-lighting—and both are available with or without local dimming technology. Each configuration offers its own advantages and disadvantages.

In an edge-lit LCD, the LED BLUs are installed along one or more outside edges of the screen, depending on the size of the display, along with light guides to ensure their illumination is dispersed across the entire screen. The advantage of placing LEDs only along the edges is this allows manufacturers to produce a very thin screen at a reduced cost. The disadvantage of this configuration is it can emphasize brightness around the edge of the screen and reduce the depth of black images, but these issues are usually not noticeable when graphics are viewed in brightly lit rooms. Other minor image uniformity issues, when viewing a screen in a dark room, can include ‘spotlighting’ in the corners and white blotches across the screen. Overall, however, pictured quality is similar to that of CCFL-backlit LCDs.

In direct-lit LCDs, also referred to as full-array LED LCDs, the LED BLUs are arranged behind the entire display panel. As a result, these screens are thicker than edge-lit LCDs, which may be a disadvantage for certain digital signage installation locations. Like their edge-lit counterparts, direct-lit LCDs provide picture quality similar to that of CCFL-backlit LCDs, but they can display deeper black performance on par with plasma displays.

Forecasting OLEDs

Organic LEDs (OLEDs), which are very thin, lightweight and flexible, are expected to eventually make their way into a significant number of displays and screens. They could find a strong opportunity in certain digital signage applications, such as small displays installed in the backs of seats in public transportation vehicles. For the time being, however, they are not yet a threat to the established LED market.

Stephen Montgomery is president of international business expansion for ElectroniCast Consultants, which forecasts market trends in LED illumination and communication networks. For more information, visit www.electronicast.com[2].

- [Image]: http://www.signmedia.ca/wp-content/uploads/2016/12/figure2Led.jpg

- www.electronicast.com: http://www.electronicast.com

Source URL: https://www.signmedia.ca/illumination-market-trends-for-led-signage-and-professional-displays/

[1]

[1]