In with the old, in with the new: Static OOH holds strong amid digital dominance

By Catherine Lee

Static out-of-home (OOH) signage is one of the oldest, most iconic forms of advertising. So, while digital out-of-home (DOOH) may now be taking centre stage, the demand for static OOH holds strong. It accounts for nearly 70 per cent of today’s available OOH market inventory. While both formats present unique challenges for media owners, Broadsign recently embarked on a journey to better understand the state of static OOH.

The company recently conducted a survey to uncover common obstacles and opportunities facing the OOH industry today and into the future, and summarized these findings in its State of Static OOH report. This deep dive provides insights and lays out a robust outlook for the year ahead, with workflow efficiency, automation, data and analytics technology, and sustainability as key areas of focus.

Broadsign’s report collected input from more than 125 OOH professionals spanning 60 companies spread across the globe, including participants across Canada. It details the challenges media owners face when managing static assets, where they see room for improvement, and predictions for how the medium may evolve in the coming years. Some of the key findings are as follows.

Abiding appeal

The report revealed that more OOH networks with static inventory are actively integrating digitization into their core strategies. More than two-thirds of participants originated from hybrid companies offering advertisers a mix of static and digital inventory across networks ranging from a few hundred screens to thousands. The number of hybrid networks is only projected to grow, as nearly 43 per cent of survey respondents said they plan to digitize more existing static faces in the next few years.

While most media owners expressed a strong interest in modernizing and making their inventory more dynamic and data-driven, the data shows static OOH is not going anywhere, anytime soon. In a digitally dominated era, static billboards still provide advertisers with a tactical alternative for their campaigns, thanks to their long-term exposure, eye-catching large formats, and strategic placements.

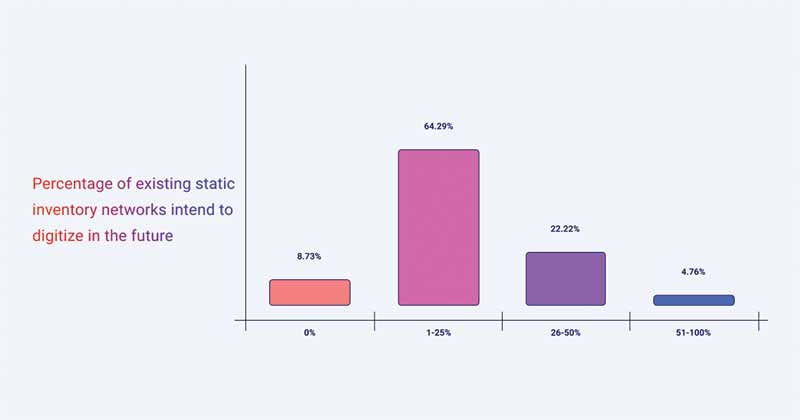

Static media’s enduring appeal is also reflected in the report, showing 70 per cent of OOH networks with inventory digitization plans intend to convert less than a quarter of their existing static faces. Additionally, 78 per cent of respondents expect these digitization efforts will not be completed for another two-to-five years.

Optimizing operations

The results of the report made it clear: The intricate processes that once defined the creation and deployment of static OOH campaigns are undergoing a transformative shift. Despite the continued success of static OOH in the digital era, most of the survey participants expressed OOH workflows remain more complex than is necessary, hindering their team’s productivity.

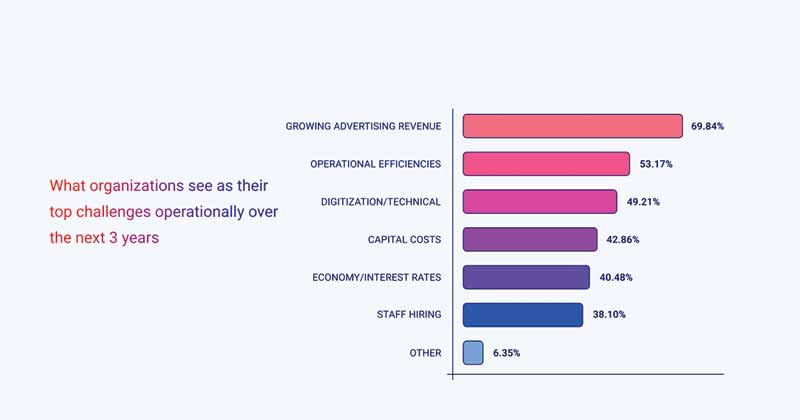

Respondents also expressed an increasing desire and need to streamline workflows to support the continued growth of their static business. Only 17 per cent said their teams operated as well-oiled machines, and nearly half felt there was ample room for workflow refinement. Moreover, 53 per cent cited operational inefficiencies as a competitive disadvantage. Participant responses also suggested the modernization and streamlining of these time-consuming static tools and workflows will be pivotal in increasing OOH’s share of advertising revenue in the coming years.

It came as no surprise that the demand for fast turnaround times, new creative opportunities, and the ability to make last-minute changes pose significant issues for many media owners still relying on time-consuming manual processes to manage their inventory. To compete with other advertising channels, static media owners must confront challenges posed by outdated inventory tracking systems and manual processes.

Tech takeover

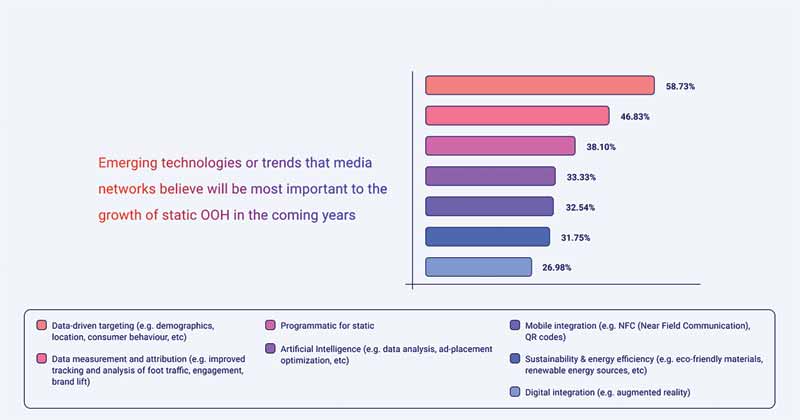

From automation tools to data and analytics solutions, emerging technologies are bringing new opportunities to the static OOH market. Many participants expressed they have begun to place more of a premium on technology

that provides real-time insights into their inventory availability, as well as data and analytics. A resounding 87 per cent believe incorporating more automation into their processes will benefit their businesses. When asked which technologies or trends would significantly impact future industry growth, 59 per cent said data-driven targeting and 47 per cent cited data measurement and attribution.

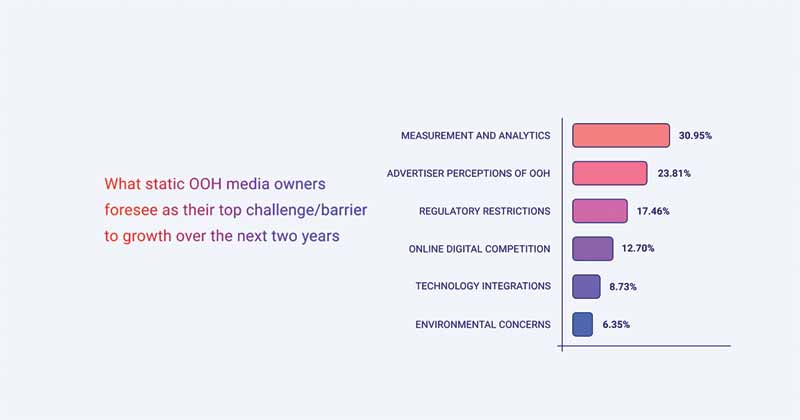

Historically, there have been perceived roadblocks around static OOH, holding advertisers at bay from investing in the medium. Modern tracking methods and automated workflows are making those hurdles a concern of the past. Now, tech advancements are not only delivering unparalleled efficiency, effectiveness, and value to every campaign, they are also increasing opportunities for both advertisers and media owners.

Tech priorities vary from one static OOH business to another, but almost all static media owners who were surveyed agreed their companies would benefit from incorporating additional automation into their processes. This can be easily addressed by investing in a static OOH management platform that can automate most tasks related to the proposal and posting process for static OOH campaigns.

Recognizing the importance of immediacy in today’s dynamic advertising landscape, static OOH companies are increasing their demand for software solutions that provide real-time insights into their available inventory, and all-in-one asset management. A staggering 75 per cent of the survey respondents cited real-time inventory availability as one of the top features they look for in a static OOH management tool.

The rise in hybrid networks blending traditional and digitized inventory means the demand for solutions that can seamlessly handle both digital and static OOH is becoming more pronounced. More than 68 per cent of static media networks surveyed recognize the importance of consolidating their management processes within a single, integrated platform.

Sustainable shift

Static OOH has historically been criticized for its perceived lack of sustainability. However, the industry is increasingly challenging these outdated stereotypes while tackling primary areas such as materials, energy sources, and current practices head-on. More OOH media networks are implementing sustainable business practices and pledging to work towards a greener, more carbon-neutral future in the last few years.

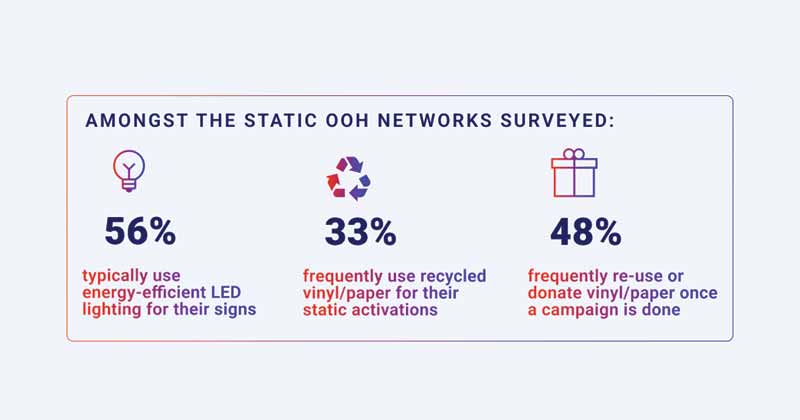

To this end, sustainability emerged as a priority among participants. With the majority of OOH networks facing increasing government restrictions around sustainability, nearly 64 per cent of the group has already pledged to reduce their carbon footprints and 17 per cent noted an intention to implement sustainability measures. As for actions already underway, 56 per cent of participants reported using energy-efficient LEDs for signage, while 33 per cent reported using recycled materials, and 48 per cent noted reusing or donating vinyl post-campaign.

The Broadsign report affirmed that static will continue to play an essential role in the OOH market. However, adapting to the times will be vital as more screens become digital. As a result, automating the tools and processes used across the industry and reducing static OOH’s carbon footprint are crucial components. The report’s findings point optimistically to the future, if everyone works together to evolve and overcome challenges along the way.

As brands continue to explore new, out-of-the-box creatives and experiment with combining OOH into multi-channel campaigns, media owners are eager to prove that traditional OOH advertising is anything but static.

Catherine Lee is the product marketing manager for Broadsign, a Montreal-based company specializing in DOOH software solutions.