By Greg Jenkins

For many smaller signmaking businesses, the performance of computer numerical control (CNC) routers continue to validate investing in this equipment, particularly the impact they have on business growth.

The decision to purchase a computer numerical control (CNC) router can be extremely difficult for some small to medium-sized businesses. On one end, this high-tech equipment offers a sign shop the ability to broaden its capabilities by reducing the time it takes to complete projects, and adapting to future production needs. On the other, companies have to weigh a number of factors when calculating the return on investment (ROI) to ensure it justifies the purchase.

No business has to be reminded about the importance of due diligence for every purchasing decision, including ROI projections. In this case, the analysis should go beyond the obvious. It not only needs to incorporate a thorough understanding of the product, but also an equally comprehensive scrutiny of the vendor as a business partner, including the role the vendor plays in ROI calculations.

For many smaller signmaking businesses, the performance of CNC routers continue to validate investing in this equipment, particularly the impact they have on business growth. Yet, the ROI and success of one company may not necessarily apply to another business with a similar operation. This is why a ROI analysis requires the full co-operation and involvement of the potential business partner whose interests are focused on the company’s growth now and into the future, and not just on making a sale.

The epitome of automation

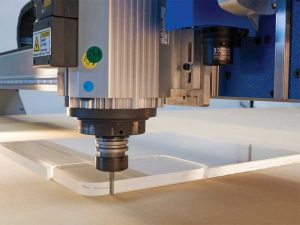

There is a substantial growth in router usage in the sign and graphics industry, which relies on automation software for converting a wide range of rigid and semi-rigid sheets of plastics, woods, and metals.

For more than two decades, CNC routers have represented the epitome of automation by aiding large and small sign shops in expanding their offerings and capabilities while reducing the amount of time they take to complete a project.

That said, in the first decade of the router’s inception and rapid growth, purchasers faced a number of issues, none of which was related to the machine’s performance, but more so everything to do with the vendor. Unwittingly, buyers were making purchasing decisions in what has been described as the Wild West.

Dozens of small machine manufacturers saw a golden opportunity in producing routers and tried to take advantage of it, sometimes with disastrous results. Within a few years, most of them either folded or merged with other manufacturers. As a result, buyers faced a difficult, threefold dilemma: worthless warranties from vendors who were no longer in business; reliable technical support became problematic, even when companies merged; and distance from the vendor. Instead of nearby facilities that would substantially reduce time and maintenance costs, the purchaser was forced to deal with lengthy wait times for technical support and/or expensive teardowns and shipping.

For many smaller signmaking businesses, the performance of CNC routers continue to validate investing in this equipment, particularly the impact they have on business growth.

These unacceptable scenarios have changed as surviving router manufacturers have become more adept. They developed technological sophistication in ways that were unheard of in the 1990s. Potential purchasers are also more sophisticated in understanding router capabilities, how to use them and, more specifically, determining the ROI for this major purchase. This expertise has been influenced and aided by the number of Internet outlets such as Google and even YouTube where router demonstrations and related information are easily accessible.

Signmaking companies turn to CNC routers for two reasons: the ability of the machinery to automate manual processes and to reduce operational labour costs by using their employees for higher value processes.

The ability to expedite workflow—another ROI factor—explains why there is a substantial growth in router usage in so many industries and markets, including, but not limited to, the sign and graphics industry, which relies on automation software for converting a wide range of rigid and semi-rigid sheets of plastics, woods, and metals.