Market trends for signage

by Matthew | 26 January 2012 12:40 pm

[1]

[1]Photo courtesy Lamar Advertising

By Stephen Montgomery

Light-emitting diodes (LEDs) are used in a variety of stationary and mobile signs and professional displays, including large outdoor video screens, building façades, stadium screens, dynamic billboards, taxi signs, indoor retail displays, restaurant and supermarket signs, channel letters, lightboxes, backlit professional-grade liquid crystal displays (LCDs) and destination signs on mass-transit vehicles. The list continues to grow.

LEDs are still considered a new, energy-saving innovation in many lighting applications. While they are becoming popular and use across the board is increasing, mainly due to ecological concerns, they are not yet widely considered an alternative to traditional light bulbs, for example, where compact fluorescent lamps (CFLs) are better-established. Even when exclusively evaluating the signage and display illumination markets relative to the future of LEDs, it can be challenging to calculate the displacement process versus traditional lighting technologies.

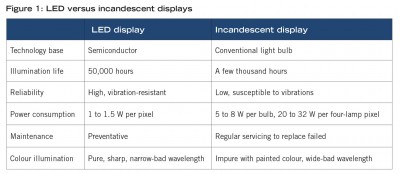

Companies involved with signage and professional displays are typically faced with comparisons between LEDs and other types of illumination, including neon, fluorescent and incandescent bulbs (see Figure 1). The appeal of LEDs in this context includes their long operating life (which averages more than 10 years), lower electrical consumption (and thus reductions in related power costs) and greater reliability through solid-state lighting (SSL) construction, among other factors.

[2]

[2]Digital billboards offer advertisers flexibility in running live updates.

This market has evolved to include digital signage and out-of-home (OOH) advertising, where personal computers (PCs) and information technology (IT) servers are used with proprietary software to control various dynamic displays. The ability to change a sign’s content allows advertising clients greater control over their messaging.

The expansion of LEDs

The following are just a few of many specific examples showing how the use of LEDs in signage and professional displays has expanded in recent years.

Billboards

Lamar Advertising has added LED-based digital billboards to its inventory of static billboards, bus and shelter posters and bench ads across Canada, the U.S. and Puerto Rico, along with highway logo signs in Ontario and 19 states. Digital advertising is offering flexibility never seen before, such as linking to social media and streaming live posts, tweets and images to the dynamic boards.

[3]Stadium screens

[3]Stadium screens

In 2011, Cinimod Studio, an architectural and lighting design firm in London, England, delivered and interactive lighting control system for the National Stadium in Lima, Peru. This system gathers the stadium crowd’s noise levels in real time and translates that audible signal into a visual map, which is then depicted on the façade’s LED display. The majority of the LEDs are laid out as fans of ‘flames’ that wrap upwards around the form of the structure. The façade’s patterns vary in colour, speed, brightness and scale.

To design this project, Cinimod—which provided custom data processing software and hardware—collaborated with an international team, including lighting design firm CAM and software designer ArquiLEDs, both based in Lima, and E:cue, a lighting control supplier in Paderborn, Germany, along with its parent firm Traxon Technologies, an SSL project manager in Hong Kong, China.

Concert displays

Belgium-based display hardware manufacturer Barco provided a ‘transformable’ LED screen in 2009 for the 360° world concert tour by the Irish rock band U2. This moving video screen had the capacity to surround the band during performances and change shape in all directions.

Barco used more than 500,000 LEDs as pixels in the 24 x 16-m (78.7 x 52.5-ft) screen. In addition, the company integrated 1,200 LED modules throughout the surrounding edges of the stages and bridges.

[4]

[4]Holiday Inn continues to update its hotels around the world with LED-based signs. Photo courtesy GE Lighting Solutions

Building signs

The hotel chain Holiday Inn has been switching to LEDs on a worldwide level. The project is expected to save the chain an estimated $4.4 million per year, due to reduced energy consumption and less need for maintenance.

The project has involved updating more than 3,200 hotels, including those in Canada, with new logo signs as part of an overall $1 billion global rebranding effort, using General Electric (GE) LEDs. The chain expects to cut the energy consumption of its signs—which are lit an average of 12 hours per day, 365 days each year—by 52 per cent. This represents an estimated reduction of 8,700 tonnes (9,590 tons) of carbon dioxide (CO2), equivalent to planting more than 930.8 ha (2,300 acres) of trees each year.

Similarly, AT&T has replaced 7,000 signs on more than 6,500 office buildings and stores with new ones using GE LEDs. These systems are expected to save the American telecommunications provider more than 5.8 million kWh per year, equivalent to planting more than 384 ha (950 acres) of trees.

One of the reasons for this change is AT&T’s backlit signs on high-rise buildings are expensive to maintain. They are usually mounted so high up that large cranes or even helicopters are needed to facilitate repairs. The LED systems not only virtually eliminate the problem of burned-out signs, but also are rated for 50,000 hours of use, eclipsing that of existing fluorescent systems by more than three years.

Transit vehicle signs

Many of the destination signs or indicators mounted on the front and sides of public transportation vehicles—including buses, light rail vehicles (LRVs), streetcars and trams—use LEDs to display route numbers and destination names. These are digitally controlled, allowing easy updates if a mass-transit vehicle’s routing is changed.

Backlit LCDs

Some of the commercial-grade flat-screen LCDs used exclusively for professional display purposes fall within the LED market category because of their backlight units (BLUs). Again, LEDs are being used in these devices because they are efficient, consuming 30 to 50 per cent less energy than conventional cold-cathode fluorescent lamp (CCFL) BLUs for similarly sized screens.

[5]

[5]In 2009, a ‘transformable’ screen for U2’s 360° world concert tour used more than 500,000 LEDs as pixels. Photos courtesy Barco

They are also more compact, enabling the design of narrower-profile LCDs.

Retail displays

Rensselaer Polytechnic Institute’s (RPI’s) Lighting Research Center (LRC) in Troy, N.Y., established the Alliance for Solid-State Illumination Systems and Technologies (ASSIST) in 2002 as an industry partnership to foster collaboration between researchers, manufacturers and government organizations, with the purpose of facilitating the broad adoption of SSL by helping to reduce major technical and market barriers.

Together, LRC and ASSIST have developed new ‘metrics’ to aid in specifying optimal light sources to illuminate retail displays. They recommend using the Color Rendering Index (CRI), which measures the ‘natural’ quality of colours, with the Gamut Area Index (GAI), which targets the relative separation of colours in an illuminated object. A higher GAI means greater saturation or vividness. LRC experiments show light sources that balance CRI and GAI are generally preferred over those that emphasize only one or the other.

Similarly, the National Institute of Standards and Technology (NIST) recently developed the Color Quality Scale (CQS) and proposed it as a standard to the International Commission on Illumination/Commission Internationale de l’Éclairage (CIE).

[6]

[6] [7]Retail accent lighting is a growing market for LEDs because they can vary in colour and aim light precisely onto display areas or specific products. Their small form factor allows them to be used unobtrusively in applications like jewellery display cases, where a ‘point source’ of light can add more sparkle.

[7]Retail accent lighting is a growing market for LEDs because they can vary in colour and aim light precisely onto display areas or specific products. Their small form factor allows them to be used unobtrusively in applications like jewellery display cases, where a ‘point source’ of light can add more sparkle.

Also, as LEDs do not radiate heat, they allow greater design flexibility when lighting temperature-sensitive goods, such as cosmetics and food. In 2010, Nualight introduced the Porto 600 line of glass door lighting for food retailers. These 8.5- to 16-W lamps are among the lowest-energy-consuming LEDs in the market, yielding 60 to 70 per cent savings compared to similar products. A single 100-W driver can easily support a five-door case.

Market forecast

High-brightness (HB) LEDs are defined, for the purposes of this article’s market forecast, as component-level bulbs—rather than chips, dies, luminaires or arrays that may include optics, a heat sink and/or a power supply—with a luminous efficacy rating of at least 30 lumens per watt. The lumen unit is equivalent to the amount of light produced through a solid angle by a source of 1-candela luminous intensity radiating equally in all directions.

(Luminous flux essentially measures the power of light perceived by the human eye. A lumen refers to physiological size, whereas a watt is a physical unit of power, measuring the rate of energy conversion.)

[8]

[8]Exterior signboards on buses are also using LEDs to support dynamic images.

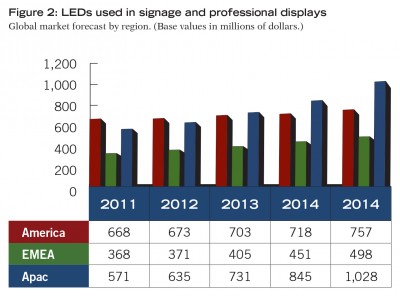

In 2011, the worldwide market for LEDs used in signage and professional displays was expected to reach $1.6 billion. By 2015, this measure of annual consumption is forecast to reach nearly $2.3 billion.

The Americas region—including North, Central and South America—led consumption in 2010 and is predicted to expand in value to nearly $757 million in 2015. The Asia Pacific (Apac) region is expanding at a faster pace, however, such that midway through the forecast period of 2011 to 2015, it is expected to take the lead in relative market share. The Europe, Middle East and Africa (EMEA) region held a 23 per cent share of global consumption value in 2011 and is also forecast to experience faster growth than the Americas region (see Figure 2), though not to top it.

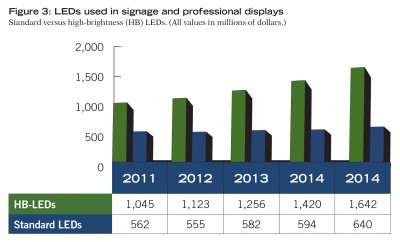

Compared to ‘standard’ LEDs, HB-LEDs held a relative market share, in terms of consumption value, of nearly 65 per cent in 2011. They are forecast to maintain this lead and reach 72 per cent in 2015, with the value of their use increasing from just over $1 billion in 2011 to more than $1.6 billion (see Figure 3).

Standard LEDs are the market share leader by far in terms of volume, having comprised 97.2 per cent of the market in 2011. It is simply because there is an enormous difference in the average selling prices of standard LEDs and their HB counterparts that the latter hold the consumption value leadership position.

Stephen Montgomery is ElectroniCast Consultants’ president of international business expansion and produces articles and presentations about light-emitting diode (LED) illumination technology, applications, installations and markets. For more information, visit www.electronicast.com[9].

- [Image]: http://www.signmedia.ca/wp-content/uploads/2014/02/DSC2897-2.jpg

- [Image]: http://www.signmedia.ca/wp-content/uploads/2014/02/ESPN-NAB-live-score3.jpg

- [Image]: http://www.signmedia.ca/wp-content/uploads/2014/02/SM_BG2012_67_fig1.jpg

- [Image]: http://www.signmedia.ca/wp-content/uploads/2014/02/Holiday-Inn-LED-Sign.jpg

- [Image]: http://www.signmedia.ca/wp-content/uploads/2014/02/U2stageBarco2.jpg

- [Image]: http://www.signmedia.ca/wp-content/uploads/2014/02/SM_BG2012_70_fig2.jpg

- [Image]: http://www.signmedia.ca/wp-content/uploads/2014/02/SM_BG2012_71_fig3.jpg

- [Image]: http://www.signmedia.ca/wp-content/uploads/2014/02/image-usa2.jpg

- www.electronicast.com: http://www.electronicast.com

Source URL: https://www.signmedia.ca/market-trends-for-signage/