New avenues for revenues surfacing for graphics providers

by eudore_chand | 3 September 2021 12:47 pm

Dundas Square, Toronto. Sign and display graphics is a growing market that offers many opportunities across a variety of industries.

By Lisa Cross, Eve Padula, and Steve Urmano

Ongoing market changes and new developments in material science have forever changed the technology landscape. Many new avenues for revenue are surfacing as providers look to take advantage of innovations and leverage existing investments.

As such, graphic communication providers are investigating new ways to grow their businesses, and sign, display, and specialty graphics represents a solid business opportunity for a variety of print service providers.

Increased competition has many firms looking to offer new products and services to bolster business from current customers, while also attracting new ones, according to an International Sign Association (ISA[1]) report, ‘Looking for Big Opportunity in Graphic Communications & Specialty Printing’.

Indeed, many providers are considering expanding into adjacent service markets where they can leverage their existing operational knowledge. To that end, firms are investing in wide-format printing devices, software, and media/substrates to further differentiate from competitors, grow revenues, and improve efficiency.

Recommendations for business growth

- Consider adding or expanding offerings: Sign and display[2] graphics is a growing market that offers many opportunities across a variety of industries. Print providers that are seeking to expand their product offerings should consider offering sign and display graphics. Companies that are already offering these products may have an opportunity to increase their market share by expanding their product lines or entering new market segments.

- Be strategic: Although the wide-format signage and graphics market is expanding, the firms that serve it must uncover and implement strategies to ensure ongoing growth. Successfully growing and expanding wide-format service capabilities starts with building on current capabilities and customers to develop new applications. Target marketing is another important strategy for consideration. An interesting finding from the study was that many providers are embracing a vertical market strategy. Firms with a strong vertical focus can capture more attention in the market, become viewed as experts within their segments, market more effectively, and productively sell to a targeted client and prospect base.

- Automate and optimize operations: Many providers have not invested in workflow software, so there is an untapped opportunity to automate production processes to improve the customer experience and remain competitive in this ever-expanding market. In addition, real-time information is critical to daily business decisions. Do you have the capacity? Can you drop your margin and still be profitable on a job? Software tools will become even more indispensable going forward. Wide-format shops that do not modernize their operations, including their business workflow, are sabotaging their future success.

To learn more about print providers’ wide-format investment plans, business priorities, workflow challenges, media/substrate usage, and application growth, Keypoint Intelligence—InfoTrends[3] recently surveyed more than 300 companies, including commercial printers, sign shops, digital print specialists, screenprinters, and ad specialty providers. The following highlights the key findings from that research.

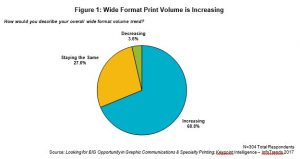

Sign and display graphics market growing

A key finding from the research study is that wide-format print is a growth market. Overall, the majority of respondents reported their wide-format print volume was increasing. In fact, respondents reported increases in wide-format volume outnumbered those reporting decreases by 17 to one. In addition, survey respondents expect wide format print volume to grow 31 per cent annually.

Firms that reported increasing print volume growth had the following similarities:

- They were expanding the applications they produced to appeal to new markets;

- They were adding services to become one-stop providers; and

- They were focusing their marketing efforts on vertical industries.

According to survey data, some of the key industries that purchase digital wide-format printing include retail, advertising, education, real estate, construction, restaurant/food service, manufacturing, personal services, healthcare, and non-profit.

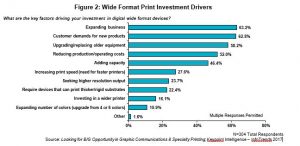

When respondents were asked to identify key factors that were driving investments, the top responses were:

- Expanding business;

- Customer demand for new products;

- Upgrading/replacing older equipment;

- Reducing costs; and

- Adding capacity.

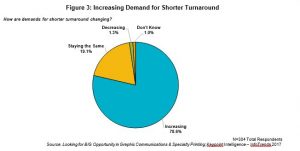

Increasing demand for short turnaround

Job turnaround requirements for wide-format print work are becoming shorter and shorter. For all company types surveyed, the majority of wide-format work is produced in less than 24-hours. In addition, respondents expected the demand for fast turnaround to increase.

Many key wide-format buying industries such as retail, advertising, events, and real estate, require fast turnaround because they are faced with staff constraints, compressed communication production cycles, and short delivery windows for finished signage.

Digital wide-format printing has changed print buyers’ expectations for fast turnaround. While certain types of wide-format jobs like store remodels, large regional/national promotions, or events, have a long sales cycle, they will tend to have a short production cycle. Print buyers want to see the effects of their campaigns and change out signage more frequently as a result.

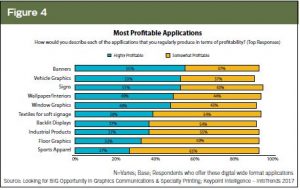

Top profitable applications by technology

Wide-format applications are becoming increasingly diverse, providing many opportunities for new entrants that are hoping to expand their offerings as well as for established sign, graphics, and visual communications companies that want to increase their market share. Respondents identified banners, vehicle graphics, signs, and wallpaper/interiors as their most profitable applications.

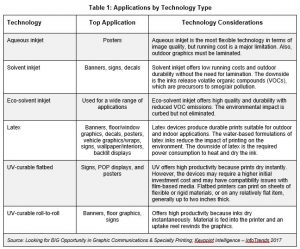

Most respondents owned UV-flatbed, solvent, and eco-solvent devices. Aqueous devices were more common among commercial printers, digital print specialists, screenprinters, and ad specialty providers. Commercial printers, sign and display shops, and digital print specialists invested the most in latex devices. The top applications that respondents produced on various devices are summarized in Table 1, along with important technology considerations.

Media trends

A key benefit of wide-format devices is they can print on a wide variety of media types. This is especially true for flatbed printing devices, as they can print directly on materials like wood, metal, plastic, glass, fabric, and many other options. Wide-format media is either flexible or rigid. According to survey respondents, 76 per cent of wide-format output was produced on flexible media. and 24 per cent was on rigid media.

The survey then asked respondents about the percentage of their work that was produced on various flexible substrates, including paper, film (excluding vinyl), banner vinyl, pressure-sensitive vinyl, canvas, fabric/textiles, and polycarbonate. Overall, pressure sensitive-vinyl (33 per cent) was the most used media, followed by banner vinyl (29 per cent) and paper (21 per cent).

According to the study, the most used flexible media types varied by company. Specifically:

- Commercial printers, digital print specialists, and ad specialty providers most commonly used paper and banner vinyl; and

- Sign and display providers and screen printers were more likely to print on pressure-sensitive vinyl and banner vinyl.

Across all company types, coroplast was the most frequently used rigid media. Rigid PVC was also popular across a variety of provider types.

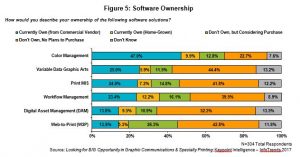

Workflow: The untapped opportunity

Workflow represents an untapped opportunity in the wide-format production process as many survey respondents have not yet invested in workflow tools to improve inefficiencies and automation. Respondents reported high ownership of colour management software, likely because colour profiling is essential, given the wide range of substrates that are used.

Workflow management is an important software category that is largely overlooked in this industry; most operations do not own workflow management software. Commercial printers and ad specialty providers were more likely than the other company types to report owning workflow. It is worth noting that workflow software is firmly entrenched among commercial printers, largely because it is required for efficient production.

Workflow management software automates production processes, and it is needed to process an increasing number of jobs and efficiently support online ordering. As wide-format printers increase in speed, prepress and finishing are often the workflow bottlenecks. A key remaining bottleneck in prepress is file handling, which is often completed by hand.

Shops must automate to improve their customer experience and remain competitive. Online ordering with automated pass through to the rest of production is key. Resources (materials, machines, and people) must also be optimized. Sheet optimization via nesting/ganging of work to save material costs and production times offers quick cost savings that typically range from $8000 to $13,000.

Another software category that many wide-format providers are ignoring is the print management information system (MIS). A print MIS is the single system of record used to store and share business-critical information within the print shop as well as to all external constituents in a timely and efficient manner. A properly implemented print MIS solution functions as the pulse and brain of a print shop.

Using an MIS system offers many benefits, including more accurate estimates, better job tracking, and identifying areas that need improvement.

[BIO] Lisa Cross is associate director for Keypoint Intelligence—InfoTrends’ Business Development Strategies service. Eve Padula is a senior research analyst for Keypoint Intelligence—InfoTrends’ Business Development Strategies, Customer Communications, and Wide-format Consulting Services, while Steve Urmano is director of InfoTrends’ Wide-format Printing Consulting Service. Urmano develops InfoTrends’ annual global market forecasts for hardware and supplies used in the wide-format printing markets.

- ISA: https://www.signs.org/

- Sign and display: https://www.signmedia.ca/publications/de/202108?page=28

- Keypoint Intelligence—InfoTrends: https://www.keypointintelligence.com/

Source URL: https://www.signmedia.ca/new-avenues-for-revenues-surfacing-for-graphics-providers/