Ongoing trends for LEDs in signs and displays

by all | 20 January 2014 8:30 am

[1]

[1]Photos courtesy Daktronics

By Stephen Montgomery

Light-emitting diodes (LEDs) are used today in a wide range of signs and professional displays, including dynamic building façades, large-format outdoor video screens, digital billboards, stadium scoreboards and other arena signage, smaller indoor retail displays, menu boards in restaurants, taxi-top screens, destination signs on mass-transit vehicles, channel letters, lightboxes, backlit liquid crystal displays (LCDs) and more.

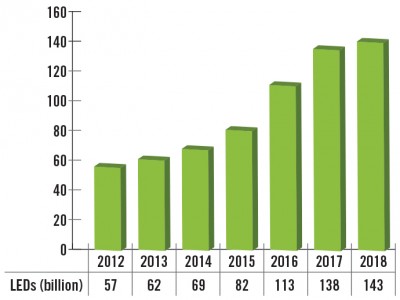

In 2012, market research shows the worldwide volume (i.e. quantity) of packaged LEDs installed in signs and other professional displays, including both stationary and vehicle-based applications, reached 57 billion units. Consumption value is predicted to increase, albeit with rising quantity growth largely offset by declining average prices. Global market consumption is forecast to reach 143 billion packaged LEDs in 2018 (see Figure 1, pictured right).

[2]

[2]Figures courtesy ElectroniCast Consultants

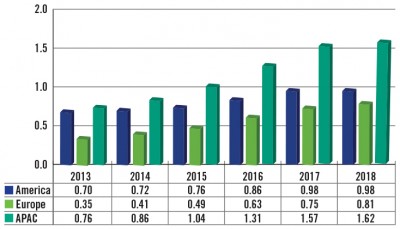

The Americas—including North, Central and South America—and the Asia-Pacific (APAC) regions are currently near-even in market share, but the latter is forecast to expand at the fastest pace, nearly 23 per cent per year, and is thus expected to dominate the marketplace in 2018 (see Figure 2, pictured below at left). Europe, the Middle East and Africa (EMEA) held a much smaller share of global consumption value in 2013 than the other regions, with 19 per cent, but are expected to see faster growth than the Americas in the period leading up to 2018.

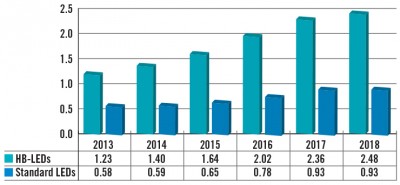

LEDs used in signage and professional displays include both high-brightness (HB) and standard-type component-level bulbs. HB LEDs are those rated at 30 lumens per watt (lm/W) and higher, while standard-type LEDs are rated for less than 30 lm/W.

In terms of consumption value, the HB LEDs are the projected leader, achieving 68 per cent of relative market share in 2013 and forecast to reach nearly $2.5 billion in 2018, followed by standard-type LEDs at $930 million (see Figure 3, pictured below at right).

Overall, the worldwide consumption of packaged LEDs in signage and professional displays was projected to reach $1.8 billion in 2013 and is forecast to reach $3.4 billion in 2018.

The following are just a few examples of how today’s increasing volumes of LEDs are being used throughout the sign and display industry.

[3]Channel letters, lightboxes and backlighting

[3]Channel letters, lightboxes and backlighting

There are many ways to illuminate a sign by day and night, including LEDs, neon, fluorescent and electroluminescent (EL) systems. There are also different techniques for lighting them, including backlighting, edge lighting, front lighting and halo lighting.

While neon and fluorescent lamps are still fairly commonly used today and can work effectively for many years, LEDs have proven a strong alternative for illuminating channel letters, lightboxes and other backlit signage applications. Indeed, they may signal the eventual demise of the older technologies.

Traditional aluminum lightboxes, which have been effective for decades and remain very common today, are as simple in design and construction as their name suggests, i.e. a box is illuminated from within. They are typically 203 mm (8 in.) thick, with a number of fluorescent tubes mounted inside to illuminate graphics applied to acrylic faces on one or both sides of the box.

When fabricated in this traditional manner, however, lightboxes consume excessive power. A typical large-format lightbox, for example, at 6 x 3 m (20 x 10 ft) in size, will require 45 58-W fluorescent tubes for effective illumination. If it is operated for only 12 hours a day, it will use approximately 12,000 kW of power per year, for an electricity bill in excess of $1,000 per year.

[4]Maintenance is another problematic issue for these signs. With just one faulty fluorescent tube, the sign presents its graphics poorly—and with 45 or more tubes in a single sign, the likelihood of a fault at any given time is rather high. Flickering and/or broken tubes quickly represent a significant ongoing cost in terms of maintenance.

[4]Maintenance is another problematic issue for these signs. With just one faulty fluorescent tube, the sign presents its graphics poorly—and with 45 or more tubes in a single sign, the likelihood of a fault at any given time is rather high. Flickering and/or broken tubes quickly represent a significant ongoing cost in terms of maintenance.

Indeed, it is common to see these signs showing dull patches or shadows across their surface. This flawed presentation will have a negative impact on consumers’ perception of the brand. It simply does not look professional, nor is it bright enough to capture the same level of attention as at the sign’s inception.

Compared to the older options, LED-based illumination provides the following benefits:

- Dramatic reductions in energy consumption and related costs.

- Significant reductions in maintenance costs.

- Thinner lightboxes, to save space in sign designs.

- More even illumination.

- Meeting regulatory requirements for greater sustainability.

Arguably the most obvious lightboxes relying on LED-based illumination today are the exit signs installed in places of business, government buildings and other facilities. Since these signs must operate non-stop, 24-7, energy efficiency has been a higher-priority consideration in their engineering than for many other types of signs. They must be clearly visible and readable at all times.

Incandescent bulbs were the first standard lights for exit signs and are still somewhat prominent in commercial buildings because of their low upfront cost, but they are the least energy-efficient option and entail the most maintenance, since they have the shortest lamp life.

Fluorescent lights have advanced technologically, with compact fluorescent lamps (CFLs) becoming a common sight. The lamps are very bright, but uneven. They are more energy-efficient and longer-lasting than incandescent bulbs, but carry a higher replacement cost. And compared to LEDs, their lamp life is only moderate.

Being small semiconductor chips that convert electricity into light without much heat emission, LEDs can provide excellent illumination over a long bulb life, using ultra-low amounts of energy. They are more expensive upfront, but carry minimal operational and maintenance costs.

The most prominent types of bulbs for exit signs, by way of example, use 40, 11 or 2 W. The traditional 40-W incandescent bulb will last six months. According to Energy Star, an international standard adopted by Natural Resources Canada’s Office of Energy Efficiency (OEE), over the course of one year, this option will entail $26 in bulb and labour costs and $39 in energy costs, for a total of $65.

The Fashion Outlets of Chicago feature 11 full-colour LED-based displays along their exterior façade.

An 11-W fluorescent bulb will last the full year. Energy Star estimates its costs over that time include $27 for the bulb and labour and $11 in energy, for a total of $38.

Finally, Energy Star claims a 2-W LED will last 10 years. With the upfront purchase and installation, the first-year costs are highest, including $20 for the bulb itself and $25 in labour, but only $2 in energy. Then, over the course of those 10 years, there are no further annual bulb and labour costs, saving hundreds of dollars in an ongoing context.

So, as operating costs for conventionally illuminated exit signs can accumulate greatly over time, it has made sense for facility managers to change out all of their old bulbs and replace them with LEDs.

Digital signage

Many ongoing evaluations of the future of LEDs have considered their potential to displace traditional lights in architectural applications, but there is a need to overcome misconceptions about their true value proposition. While many applications of LEDs are indeed intended to replace existing fixtures, others are using LEDs as a new model for ‘digital light,’ exploiting dynamic ways to control light to provide information. Hence, they have become highly useful in the digital signage sector.

The Fashion Outlets of Chicago opened in August 2013 along Interstate 294 (I-294) in Rosemont, Ill., not far from Chicago O’Hare International Airport. In the hope of attracting both visitors’ and locals’ attention as the closest outlet mall to Chicago, the two-level, 49,239-m2 (530,000-sf) building features approximately 1,720 m2 (18,500 sf) of outdoor digital video screen space.

This space comprises a series of 11 full-colour LED-based displays along the mall’s exterior façade. They were built by Daktronics, which is reportedly now the world’s largest supplier of computer-programmable displays, large-format video screens, digital billboards, electronic scoreboards and the corresponding control systems.

The 11 displays include the following size formats, in ascending order:

- Six units that are 9.1 x 6.1 m (30 x 20 ft) each.

- Two units that are 6.1 x 18.3 m (20 x 60 ft) each.

- One unit that is 5.5 x 41.5 m (18 x 136 ft).

- One unit that is 5.5 x 49.1 m (18 x 161 ft).

- One unit that is 5.5 x 120.5 m (18 x 395 ft).

Featuring a series of static advertising images, the screens represent the largest outdoor LED display installation at any North American shopping centre development. This may be only fitting, as the building—co-owned by AWE Talisman and Macerich—is the first multi-level, fully enclosed shopping centre anywhere in the world, with a mix of more than 150 factory outlet stores and brand-name retailers.

“The new digital displays advertise the mall’s special events and promotions, along with the retailers and restaurants located inside the facility, while also keeping spots available for purchase by outside advertisers,” explains Ann Ackerman, AWE Talisman’s vice-president (VP) and director of marketing. “They present an incredible opportunity to engage our consumers from the moment they approach the property.”

More and more, outdoor video advertising is providing a means for shopping malls like the Fashion Outlets of Chicago to carry out special marketing programs, create ‘buzz’ and bring in sustainable revenues. With the touch of button, the displays’ operators can switch between ads for a mall’s stores, social media promotions, exclusive event listings and other content.

While LED-based digital signage is primarily known as an outdoor medium, viewed from a farther distance than LCDs, it also has indoor applications. Daktronics, for example, built an indoor LED display for the Hollywood Casino at Penn National Race Track in Grantville, Penn. A main ‘serpentine’ structure is accompanied by two curved, scrolling marquees (pictured below) that present Hollywood entertainment news.

[5]

[5] [6]

[6]The primary 22.8-m (75-ft) long display structure is composed of five 0.3 x 20.3-m (1 x 66.5-ft) ribbon displays and one 1.9 x 2.5-m (6.3 x 8.3-ft) display, for a total of 40.4 m2 (435 sf). It showcases on-premise video footage, movie trailers, animation, footage of famous Hollywood stars and big-ticket sporting events.

“This was a challenging project,” said Daktronics project manager Jesse Johnson, “but working with the designer, Andy Young from Genisis, and the architect, Elroy Sutherland from Urban Design Group, we provided a centrepiece for the main entrance of the casino that generated a ‘wow’ effect. The end result is a video display like no other.”

“Daktronics has already demonstrated its ability to deliver displays with irregular curves and shapes, but the video quality exceeded what we thought it was going to be,” said John Wise, the casino’s manager. “The video jumps off the display and immediately grabs your attention when you walk into the building.”

In these ways, LEDs are becoming more popular in a wide range of signs and professional displays, driven not only by ecological concerns, but also by the desire to create new shapes and images.

Stephen Montgomery is president of ElectroniCast Consultants, which specializes in forecasting trends in LED illumination and consulting for companies, trade associations, government agencies and the financial community. For more information, contact him at stephen_montgomery@electronicastconsultants.com[7].

- [Image]: http://www.signmedia.ca/wp-content/uploads/2014/01/dsc00165.jpg

- [Image]: http://www.signmedia.ca/wp-content/uploads/2014/01/LEDS_Figure1.jpg

- [Image]: http://www.signmedia.ca/wp-content/uploads/2014/01/LEDs_Figure2.jpg

- [Image]: http://www.signmedia.ca/wp-content/uploads/2014/01/LEDs_Figure3.jpg

- [Image]: http://www.signmedia.ca/wp-content/uploads/2014/01/HollywoodCasino.jpg

- [Image]: http://www.signmedia.ca/wp-content/uploads/2014/01/HollywoodCasino-2.jpg

- stephen_montgomery@electronicastconsultants.com: mailto:stephen_montgomery@electronicastconsultants.com

Source URL: https://www.signmedia.ca/ongoing-trends-for-leds-in-signs-and-displays/