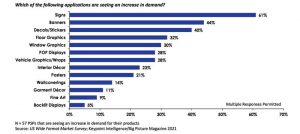

Figure 2 – Applications experiencing an increase in demand.

Durable ink

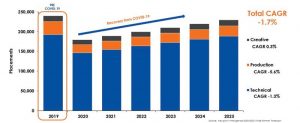

Today’s PSPs are demanding inkjet technologies that enable them to complete jobs as quickly as possible. This trend is fuelled by an increase in online ordering and web-to-print, as well as customer expectations associated with these ordering platforms. Durable ink technology enables faster job turnaround as the ink is ready for any finishing right away—or at least relatively quickly in the case of solvent. This trend is driving unit sales growth expectations for the ultraviolet (UV), latex, and solvent categories. While unit sales are moving to UV and latex as customers demand faster turnaround times, solvent still has the majority market share. Overall durable ink printer placements will demonstrate a CAGR of 1.5 per cent through 2025.

A deeper dive by durable ink segment

The solvent durable ink category will show a CAGR of 0.8 per cent through 2025. All placement growth is expected to result from increased sales of low-end, sub-$20,000 devices that are often under 762 mm (30 in.). Indeed, these specific devices saw a strong increase in demand during the lockdown phase of the pandemic when professionals were urged to stay home. Although solvent unit sales are expected to grow, they are losing share to UV and resin/latex devices.

Overall, UV placements will see a CAGR of 4.6 per cent between 2019 and 2025, partially because UV is the most versatile of all ink technologies with capabilities to print directly on rigid and flexible substrates.

The resin/latex durable ink category is projected to achieve a CAGR of 1.7 per cent during the forecast period, solely driven by sales of hybrid flatbed/roll-to-roll printers. Keypoint Intelligence believes a true flatbed segment might be added to the resin/latex segment in the future, increasing the attraction to this ink technology.

Dye sublimation (signage and graphics)

Although dye sublimation ink printer placements took a hit between 2019 and 2020, they are expected to achieve healthy growth over the current forecast period, with full recovery by 2023 and a further 2.9 per cent CAGR through 2025. It is important to note, despite this growth in placements, the installed base will level out as higher volume users continue to transition into the larger décor printer market.

Key industry trends

The following are the top trends Keypoint Intelligence expects to shape the market in the coming year and beyond.

Labour shortages will increase the need for workflow automation

As we continue to recover in the aftermath of COVID-19, the labour landscape has changed dramatically. Looking forward through 2022 and beyond, all PSPs will need to produce more with fewer staff members, so the need for an automated workflow is no longer reserved for high-volume facilities. Firms of all sizes will increasingly implement software solutions to streamline the entire process, including onboarding, production and finishing, kitting, shipping, and fulfilment.

Substrate flexibility will be required in order to navigate supply chain disruptions

The supply chain disruptions that occurred at the onset of the pandemic will continue to wreak havoc on everything from timelines to the cost of operation. Despite these challenges, there are also opportunities. Resourceful PSPs, particularly those that have UV curable devices that can print on nearly any substrate, can direct their clients to use in-stock substrates. By doing this, the work can be completed within the client’s timeline rather than being forced to wait for specific materials.