Printing goes wide

by carly_mchugh | 21 July 2022 12:25 pm

[1]

[1]By Eric Zimmerman and Eve Padula

It has been more than two years since the COVID-19 pandemic took the world by storm, and the changes that have occurred since then have been unprecedented. The wide-format printing industry was certainly not immune to these shifts. Signage and graphic communications are an essential part of our society, so many wide-format print service providers (PSPs) were able to pivot their applications and effectively weather the storm.

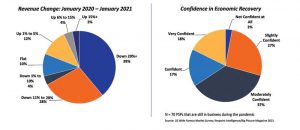

Although year-over-year revenue volumes were down in 2021, most PSPs were moderately confident about a near-term economic recovery.

Since volumes were down from pre-pandemic numbers, it should come as no surprise that most PSPs were cautious about their equipment purchases in 2021. In fact, nearly two-thirds (64 per cent) of PSPs were not planning on purchasing new equipment in early 2021. The good news is wide-format printing purchases have rebounded somewhat since that time.

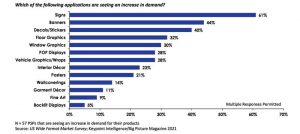

Despite the disruptions of the COVID-19 pandemic, wide-format applications remained stable in relation to many other print applications. When PSPs were asked about the types of products that were seeing an increase in demand, the most common responses included signs, banners, and decals/stickers. Floor graphics also saw a spike in demand during the height of the pandemic when social distancing was enforced.

As we move through the remainder of 2022, the wide-format print industry will continue its recovery. However, even as demand increases, supply chain disruptions, labour shortages, and concerns about COVID-19 variants will continue to create challenges. This article provides a forecast overview and explores wide-format growth areas expected to help the industry regain lost volumes in 2022 and beyond.

[2]

[2]Ink technology forecast

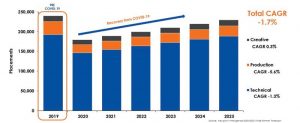

According to Keypoint Intelligence’s (KPI’s) most recent forecast data, placements of all wide- format technologies are expected to remain generally flat between 2019 and 2025. At the same time, however, this flatness should be viewed as a recovery based on the steep decline printer placements experienced across all ink technologies between 2019 and 2020. All technologies are expected to further recover as we move through the current forecast period.

It is important to note this forecast data would typically cover a five-year compound annual growth rate (CAGR) from between 2020 and 2025. That said, it is critical to establish a pre-COVID benchmark to measure the rate of recovery. To create a clear and realistic viewpoint of the market, KPI will be utilizing a six-year CAGR (2019-2025) in this article.

Aqueous

After performing under forecast in 2019 and then being confronted with the pandemic, the aqueous ink wide-format printer category saw a 25 per cent decline in unit sales between 2019 and 2020. The production segment experienced the largest rate of decline (38 per cent) year over year, as well as a 27 per cent drop in print volumes. In contrast, the creative segment saw the smallest decline in year-over-year unit sales (12 per cent). As a result, this category is expected to experience a quicker recovery through 2025.

While the overall segment is well on the way to recovery, it is quite likely it will still take some time to reach pre-pandemic placement levels.

Durable ink

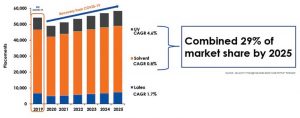

Today’s PSPs are demanding inkjet technologies that enable them to complete jobs as quickly as possible. This trend is fuelled by an increase in online ordering and web-to-print, as well as customer expectations associated with these ordering platforms. Durable ink technology enables faster job turnaround as the ink is ready for any finishing right away—or at least relatively quickly in the case of solvent. This trend is driving unit sales growth expectations for the ultraviolet (UV), latex, and solvent categories. While unit sales are moving to UV and latex as customers demand faster turnaround times, solvent still has the majority market share. Overall durable ink printer placements will demonstrate a CAGR of 1.5 per cent through 2025.

A deeper dive by durable ink segment

The solvent durable ink category will show a CAGR of 0.8 per cent through 2025. All placement growth is expected to result from increased sales of low-end, sub-$20,000 devices that are often under 762 mm (30 in.). Indeed, these specific devices saw a strong increase in demand during the lockdown phase of the pandemic when professionals were urged to stay home. Although solvent unit sales are expected to grow, they are losing share to UV and resin/latex devices.

Overall, UV placements will see a CAGR of 4.6 per cent between 2019 and 2025, partially because UV is the most versatile of all ink technologies with capabilities to print directly on rigid and flexible substrates.

The resin/latex durable ink category is projected to achieve a CAGR of 1.7 per cent during the forecast period, solely driven by sales of hybrid flatbed/roll-to-roll printers. Keypoint Intelligence believes a true flatbed segment might be added to the resin/latex segment in the future, increasing the attraction to this ink technology.

[3]

[3]Dye sublimation (signage and graphics)

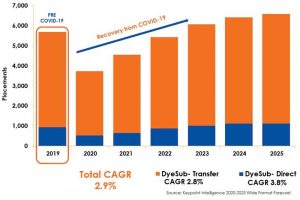

Although dye sublimation ink printer placements took a hit between 2019 and 2020, they are expected to achieve healthy growth over the current forecast period, with full recovery by 2023 and a further 2.9 per cent CAGR through 2025. It is important to note, despite this growth in placements, the installed base will level out as higher volume users continue to transition into the larger décor printer market.

Key industry trends

The following are the top trends Keypoint Intelligence expects to shape the market in the coming year and beyond.

Labour shortages will increase the need for workflow automation

As we continue to recover in the aftermath of COVID-19, the labour landscape has changed dramatically. Looking forward through 2022 and beyond, all PSPs will need to produce more with fewer staff members, so the need for an automated workflow is no longer reserved for high-volume facilities. Firms of all sizes will increasingly implement software solutions to streamline the entire process, including onboarding, production and finishing, kitting, shipping, and fulfilment.

Substrate flexibility will be required in order to navigate supply chain disruptions

The supply chain disruptions that occurred at the onset of the pandemic will continue to wreak havoc on everything from timelines to the cost of operation. Despite these challenges, there are also opportunities. Resourceful PSPs, particularly those that have UV curable devices that can print on nearly any substrate, can direct their clients to use in-stock substrates. By doing this, the work can be completed within the client’s timeline rather than being forced to wait for specific materials.

Online marketing and ordering will accelerate

As is the case with many other industries, web-to-print and workflow still have a great deal of growth potential in the wide-format print market. Prior to the COVID-19 outbreak, many PSPs did not feel compelled to have an online presence apart from a gallery site because almost all business was handled in person. The consumer market is a bit different. Even pre-COVID, many consumers were comfortable purchasing a wide variety of products online, and this trend has only accelerated over the past few years. During the lockdown phase of COVID, PSPs began to express a greater interest in an online platform, but this trend seems to have leveled off since then. During a panel discussion moderated by Keypoint Intelligence in early 2022, two out of three panelists said they did not have any digital carting system set up for online shopping. The third panelist only had an online system in place for generic items. Like the other panelists, most of his workflow was customized for clients with complex needs. As a result, a web-to-print system would be of little use. Rather than turning down business, though, he set up a cart system for standard items that was fully integrated and automated to not pull any personnel from the custom, hands-on work with their primary clients. These web-to-print offerings accounted for about 10 per cent of his total revenues, and the online component didn’t need to be staffed with new employees. As time goes on, more forward-thinking PSPs will likely place a greater focus on their online presence and find a way to incorporate web-to-print capabilities into their workflows.

[4]

[4]The movement toward sustainability will continue

As sustainability becomes a bigger business priority due to legislation and customer preferences, wide-format printer manufacturers will continue to take steps to make their products and services more eco-friendly. For example, some are incorporating plastic alternatives as well as recycled materials into their wide-format printers, supplies, and packaging. These updates are enabling them to obtain environmental product labels that can differentiate them from the competition and attract business from eco-minded customers. PSPs are also seeing an increased customer demand for PVC-free products and sustainable work practices. This trend will only accelerate as environmental regulations become more stringent each year. Savvy PSPs and manufacturers will take the opportunity to align their offerings with customer demand and produce devices and applications that can be promoted as sustainable.

The bottom line

Without question, COVID-19 has changed a great many things about our world, and the wide-format industry—like so many others—is still dealing with its effects. At this point, expecting a return to pre-pandemic “business as usual” is wishful thinking. Customer buying patterns have shifted, turnaround times are shorter than ever, and there has never been a greater need to produce more with less.

The good news is the wide-format industry is resilient and continues to reinvent itself. Some manufacturers have taken the initiative to develop new hardware and software products, and these offerings can help PSPs better address the needs of today’s continually evolving market.

Eric Zimmerman is the principal analyst of Keypoint Intelligence’s wide-format printing consulting service, developing annual global market forecasts for hardware and supplies used in the wide format printing markets. With over 25 years of experience in the wide-format market, Zimmerman is responsible for conducting multiple primary research studies within the wide-format market.

Eve Padula is the senior consulting editor for Keypoint Intelligence’s business development strategies, customer communications, and wide-format consulting services. Her responsibilities include the promotion and distribution of content, assisting clients and channels in building business development programs, handling data analysis for forecasts and research reports, and managing the editing cycle for many types of deliverables.

- [Image]: https://www.signmedia.ca/wp-content/uploads/2022/11/bigstock-Toronto-Canada-449895699.jpg

- [Image]: https://www.signmedia.ca/wp-content/uploads/2022/11/trends_Fig-1-Confidence.jpg

- [Image]: https://www.signmedia.ca/wp-content/uploads/2022/11/trends_Fig-3-Aq-ink.jpg

- [Image]: https://www.signmedia.ca/wp-content/uploads/2022/11/trends_Fig-5-Dye-sub-ink.jpg

Source URL: https://www.signmedia.ca/printing-goes-wide/