Wide-format Graphics: The industrial printing revolution

By Frazer Chesterman

By Frazer Chesterman

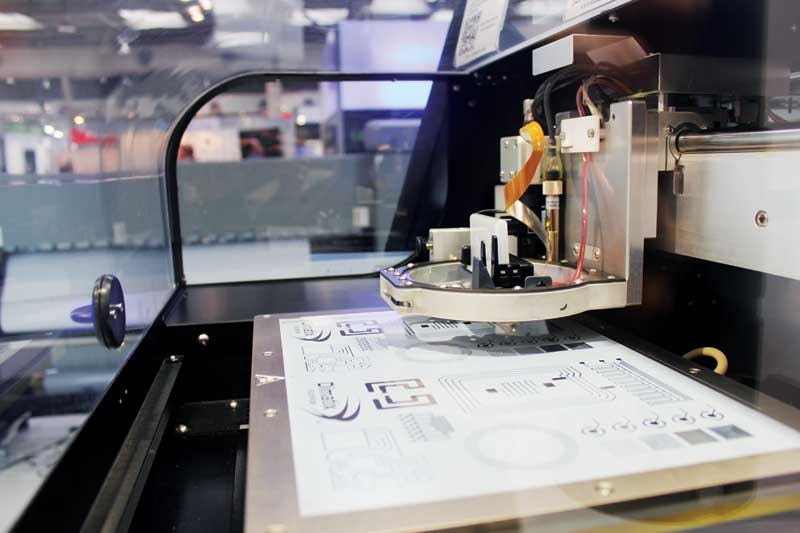

There is an ‘industrial revolution’ going on today in the digital inkjet printing industry, with rapid growth in new market segments for the depositing of inks onto manufactured products for decorative purposes. Examples that represent opportunities for sign shops include interior décor, ceramics, laminates and textiles.

Digital inkjet technology is opening these new markets today much as it did earlier for traditional commercial wide-format graphics, which now represent a mature market where growth is slowing down. The biggest or strongest wide-format printing companies are not necessarily the ones that will survive upcoming changes; rather, those that can evolve and adapt will be the most successful.

The changing landscape

The global market for functional and industrial printing was valued at $67.4 billion U.S. in 2015, up substantially from $31 billion U.S. in 2010, according to Smithers Pira, a market research and testing firm for the printing, packaging and paper industries. It is set to grow to $107 billion U.S. by 2020.

In January 2016, many printing industry professionals across the globe were surveyed for an Industrial Print Show (InPrint) market report, conducted with the assistance of IT Strategies, a consultancy serving digital print vendors. More than 50 per cent predicted a steady year-over-year growth rate of between five and 10 per cent for industrial printing, while nearly 34 per cent predicted double-digit growth (i.e. greater than 10 per cent). Only

15 per cent predicted zero to slight growth.

Western Europe has led the integration of industrial inkjet printing technologies and processes. Results of the InPrint survey suggest the next most significant manufacturing centre is North America (58 per cent), followed by China (43 per cent), Japan (36 per cent), Eastern Europe (27 per cent) and Southeast Asia (19 per cent).

On a global scale, the market for industrial printing is driven by changes in both supply and demand, as customers seek greater speed, efficiency and flexibility, while the shift to digital manufacturing makes local production more feasible for many applications.

Innovations in both digital printer technology and the related inks and coatings have driven the supply side of the equation. There have been improvements in ink deposition, adhesion and robust durability. Most importantly, digital printing has become a cost-effective method of manufacturing.

In the InPrint survey, nearly 70 per cent of respondents cited technological innovation as one of the main drivers of growth, followed by changing customer demand trends at 56 per cent, shifts to digital manufacturing at 42 per cent and localization at nearly 13 per cent.

Survey participants were also asked which benefits they were looking to gain when investing in new technology. The top answer, at approximately 75 per cent, was to open new application possibilities. This was followed by more flexible production (51 per cent), lower production costs (46 per cent), more customized production output (38 per cent), better-quality image reproduction (33 per cent) and more automated production output (29 per cent).