Own or outsource?

One example of how digital printing is enabling more efficient operations is in how sign shops manage their inventory. In the early 1990s, for instance, when shops made signs primarily by cutting vinyl, they needed to manage an inventory of many different colours of films. In digital printing, on the other hand, all of the vinyl is white before being decorated, so there is less need to tie up cash in multiple types of inventory.

Also, many signmakers realize they do not have to own all of the equipment they could possibly need to serve their customers. In some cases, it is advantageous to outsource work they are unable to do in-house. In fact, even while digital printing is the industry’s primary production method, the survey showed a diversity of approaches:

• 21 per cent of respondents do not have their own printers and, hence, outsource all wide-format print production.

• 33 per cent own wide-format digital printers and do not outsource related work.

• 46 per cent have their own printers, but still outsource sometimes.

Further, sign shops often own multiple devices, representing multiple wide-format printing technologies. There are several reasons for this, including the need for multiple devices

to satisfy production capacity requirements;

or a ‘lean’ manufacturing strategy where several of the same type of device are used to provide redundancy.

Further, sign shops often own multiple devices, representing multiple wide-format printing technologies. There are several reasons for this, including the need for multiple devices

to satisfy production capacity requirements;

or a ‘lean’ manufacturing strategy where several of the same type of device are used to provide redundancy.

Despite the rise of digital printing, analogue equipment—including colour cut vinyl plotters and screenprinting presses—is holding on. When asked how many analogue machines they owned, sign shops’ survey responses in this category averaged 2.3.

The next most common multiple in-house printers were aqueous inkjet models at 1.8. This is probably because many shops use one as a proofing system and another as a production system.

Ultraviolet-curing (UV-curing) roll-to-roll and durable aqueous ‘latex’ inkjet printers tied at 1.5, while UV-curing flatbed, UV-curing hybrid, dye sublimation, solvent-based and eco-solvent inkjet printers all tied at 1.3. In other words, shops typically have one of these printers, rather than a fleet of the same type.

Printers of choice

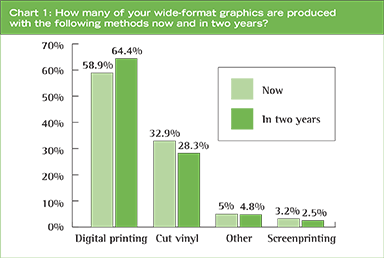

Digital technology is continuing to transform the sign and graphics market. Already, shops report digital printing accounts for more than half of their production output and they expect it to make up a greater share in the near future (see Chart 1).

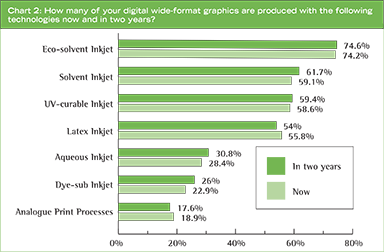

Eco-solvent inkjet is the dominant wide-format digital printing technology among the sign and graphics shops surveyed by InfoTrends, with 52.9 per cent uptake. This is not altogether surprising, as it is a suitable choice for printing a diverse range of durable graphic applications at a low initial price and with competitive running costs. Some of the most popular eco-solvent devices include integrated cutting systems, providing additional value for small shops that need to contour-cut graphics.

The next most common technology is solvent-based inkjet at 25.3 per cent. While it is clear many sign shops are now shifting some of their print volume away from these machines, solvent-based printing offers very low-cost production for out-of-home (OOH) advertising applications, for which print buyers tend to be highly price-sensitive.

The next most common technology is solvent-based inkjet at 25.3 per cent. While it is clear many sign shops are now shifting some of their print volume away from these machines, solvent-based printing offers very low-cost production for out-of-home (OOH) advertising applications, for which print buyers tend to be highly price-sensitive.

UV-curing hybrid and aqueous inkjet printers tie at 15.3 per cent, followed closely by latex at 14.1 per cent. This latter statistic is notable because latex is still a fairly new option, so its adoption is going well in the sign and graphics market as a replacement for traditional aqueous, eco-solvent and solvent inkjet printers.

UV-curing flatbed and roll-to-roll printers follow at 11.8 and 7.6 per cent, respectively. Of course, when counting all different configurations of UV inkjet printers combined, 34 per cent of surveyed shops own at least one.

While sign shops that own analogue machines tend to own several of them, these shops are no longer as common as they once were. Only 5.3 per cent of surveyed shops report owning analogue wide-format printers, followed by the dye sublimation niche at 4.1 per cent.