Subtle shifts

Subtle shifts

The companies that are investing in higher-end wide-format digital printers typically do so to become more competitive in terms of keeping running costs low and expanding the type of applications they can produce. With this in mind, survey respondents report they expect to make only subtle shifts into various technologies in the next two years (see Chart 2). They anticipate slight growth in eco-solvent, solvent, UV and aqueous printing production, a more notable increase in dye sublimation—faster than any other production method—and, surprisingly,

a small shift away from latex. The changes

in a two-year time frame might seem fairly small, but they indicate the directions sign and graphics producers may be taking.

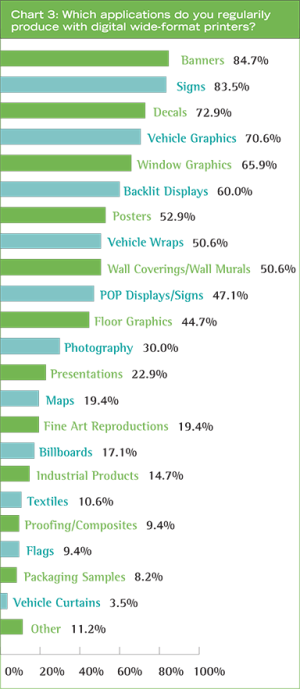

One of the most important considerations when it comes to the choice of technology is the mix of applications the sign shop produces, but here too there has not been much change in the mainstream. When survey participants were asked which applications they regularly output on their digital wide-format printers (see Chart 3), banners and signs were the most common answers, followed by decals, partial vehicle graphics, window graphics, backlit displays, posters, full vehicle wraps, wall murals, point-of-purchase (POP) displays, floor graphics and large-format photography. Less common were fine art reproductions, billboards, printed textiles and flags.

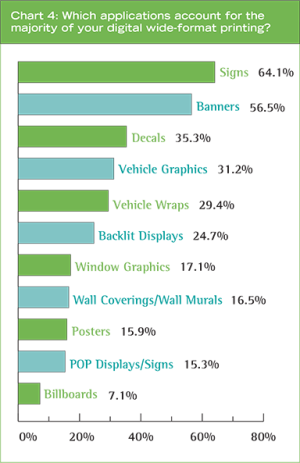

Somewhat similarly, they were asked which applications are the most important or account for the majority of their digital wide-format printing (see Chart 4). As one would expect from a group largely comprising sign shops, their top answer was signs, followed by banners, decals, vehicle graphics and wraps, backlit displays, window graphics, wall murals, posters, POP displays and billboards. (This application mix reconciles with the substrate mix used by respondents, which includes a very high percentage of vinyl.)

Still a growth market

Perhaps just as important as which applications are commonly produced by

sign shops today and what drives the majority of their wide-format output volume are the current trends relating to specific applications. With this in mind, survey participants were asked which types of applications are growing and which are declining, as a percentage of their total digitally printed wide-format volume. There were several important results among their responses.

First, 75 per cent of companies producing signs report they represent a growing application. InfoTrends suggests this is a result of the shops’ customers seeking to change out their messaging more frequently to drive sales activity for their own products and services.

Similarly, wall murals are rated as a growing application by nearly 70 per cent of respondents. InfoTrends credits this not only to another market demand to change out messaging, but also to the emergence of latex inks, which avoid the odours associated with offgassing solvents. Latex-printed wallcoverings have helped bring wide-format graphics to environments with stricter indoor air quality (IAQ) requirements than traditional sign locations.

The trend for printed textiles may be less clear. While 60 per cent of respondents report it is growing, nearly 17 per cent say it is in decline. InfoTrends suggests it is indeed a growth market, but one where new entrants may be negatively affecting smaller suppliers.

It is important to recognize not even one application among all those listed was reported by respondents to be in greater decline than growth. This reinforces the notion that wide-format digital printing remains a growth market overall.

Fragmented substrates

Fragmented substrates

The wide-format digital printing business is fragmented in terms of suppliers, hardware and types of substrates. As a result, many brands of pressure-sensitive media are used. InfoTrends’ survey presented more than 30 of these brands to participants and asked them to identify which, if any, they currently use. While some of the brands came out on top, including 3M, Avery Dennison, Arlon and Orafol (previously known as Oracal), respondents overall report using at least some of all of the brands and, for that matter, 10.6 per cent report using other brands not on the list.

Behind the aforementioned top brands in the rankings was a mix of dedicated vinyl suppliers—including Ultraflex, Mactac, Cooley, Clear Focus, InteliCoat Technologies/Magic Inkjet and Sihl—and wide-format printer manufacturers that provide their own compatible media—including HP, Roland DGA and Epson. Further behind were more specialized substrate suppliers like Fisher Textiles and Value Vinyls.

Survey participants were also asked how important certain factors are in determining which brands of media they use. Their responses suggest most sign shops select products based on practical characteristics like durability, print quality and cost, as they want their customers to be happy with the performance, appearance and price of the graphics they produce.

Other characteristics of importance relate to the value conveyed by the manufacturers and their distribution channels, including a product’s warranty, high availability (in terms of speed) and low roll-to-roll variability. It is interesting to note respondents rate ‘previous experience with the brand’ just as highly as ‘fastest availability,’ which suggests they would be willing to replace their currently used brands with alternatives that are more easily available.

Another interesting finding was the lack of importance attributed to choosing substrates that are least hazardous to the environment. InfoTrends suggests, more than anything else, this reflects the size of the average facility among the respondents. In other research studies, the company has found very large wide-format printing businesses are more concerned with environmental issues because (a) they are more likely to support large customers with their own environmental practices and policies that affect sign and graphics procurement and (b) they are more acutely aware of the cost of disposal for large quantities of non-recyclable materials.

At any rate, the data from respondents reinforces InfoTrends’ perception of the sign and graphics market as a dynamic one where suppliers are challenged to continue to develop products to help expand the sign business, while also streamlining their supply chains.