Comparison shopping

Wide-format media for digital printing are very important cost elements for sign

shops. The average shop spends thousands

of dollars per year on pressure-sensitive vinyl.

Among survey respondents, the mean annual expenditure on wide-format print media was nearly $47,000. Further, sign shops clearly expect their business to grow, as 63 per cent of respondents report they will spend more on media over the next year than they did in the previous year.

The most common digital print output widths among survey respondents are 1.37 m (54 in.), which coincides with the size of many leading eco-solvent printers, and 1.2 m (48 in.), which is very common for flatbed printers.

The growth of UV-curing inkjet printers, particularly the flatbed models, is also driving growth in the use of rigid substrates, which now account for 14.5 per cent of respondents’ output, compared to 85.5 per cent for flexible media. Flatbed UV printers typically require a very significant upfront investment, but offer productivity advantages because graphics can be printed directly onto rigid media without the need for separate mounting in the finishing department.

Among the rigid media mix, the most commonly used substrate is Coroplast, the corrugated plastic sheet manufactured since 1975 in Granby, Que. (and now elsewhere), followed by rigid polyvinyl chloride (PVC) sheets, metal composites, acrylic, polycarbonates and wood fibre composites.

Among the rigid media mix, the most commonly used substrate is Coroplast, the corrugated plastic sheet manufactured since 1975 in Granby, Que. (and now elsewhere), followed by rigid polyvinyl chloride (PVC) sheets, metal composites, acrylic, polycarbonates and wood fibre composites.

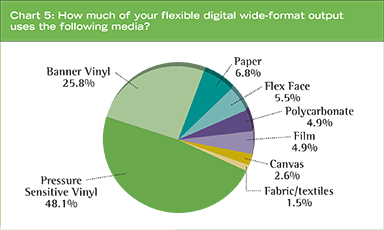

As mentioned earlier, vinyl is dominant in the flexible wide-format media market. Survey respondents report 48.1 per cent of their flexible graphic output uses pressure-sensitive vinyl and 25.8 per cent uses banner vinyl; together, they comprise nearly 75 per cent of the total. Papers, flex-face materials, films, polycarbonates, canvasses and fabrics/textiles account for much smaller percentages (see Chart 5).

One reason for these results is the versatility of pressure-sensitive vinyl, which sign shops use for a wide variety of their top applications, including vehicle wraps, backlit signs, window graphics and wall murals. Almost 25 per cent of their reported use of pressure-sensitive vinyl involves mounting it to a flat panel, however, which suggests many sign shops could benefit from adopting UV-curing flatbed printers and, in doing so, reducing their costs of labour and additional media for mounting.

Within the vinyl segment, respondents report 86.5 per cent of the material they use is adhesive-backed. This reflects their strong focus on signs and vehicle graphics over other non-adhesive-backed applications (13.5 per cent).

Another way to categorize vinyl is coated or uncoated. Respondents say 69.2 per cent of the vinyl they use is topcoated, which is more expensive than uncoated vinyl (30.8 per cent), but typically improves the image quality of the resulting prints.

Wall murals are a growing trend, thanks in part to latex inks, which have helped them gain acceptance in facilities with strict indoor air quality (IAQ) requirements. Photo courtesy LexJet

Prices also differ between more expensive cast vinyl and less expensive calendered vinyl. Going into this study, InfoTrends had theorized the majority of digital printing volume would use calendered vinyl, but in fact the market was nearly evenly split, with survey respondents saying they use 51.1 per cent cast and 48.9 per cent calendered vinyl. InfoTrends concluded the higher-than-expected rate of cast vinyl consumption was due to requirements for longer-term image durability in the sign industry.

Other services

Finishing remains an important part of wide-format graphics production, especially lamination. Sign shops laminate graphics for

a number or reasons, including weather and graffiti resistance, enhanced durability and

the professional appearance of a glossy or matte finish. Among the survey respondents, approximately 62 per cent of the graphics they produce are laminated.

In addition to printing and finishing, customers demand a variety of other services from sign shops. Of the survey respondents, 73.3 per cent offer delivery, 71.7 per cent offer pre-press services—such as graphic file manipulation—to prepare graphics for printing and 67.5 per cent offer installation.