Wide-format Graphics: Today’s print and media mix

by all | 28 November 2014 9:14 am

[1]

[1]Photos courtesy of Roland DGA

By Glenn Feder

Digital printing is now well-established as the primary production method in the sign and graphics market, but it is being used in many different ways. The International Sign Association (ISA) recently released a new study conducted by InfoTrends, a document technology market research and consulting firm, in consideration of the importance of wide-format digital printing and dye sublimation to today’s sign and graphics industry. One of the goals was to determine which printing tools and technologies ISA’s members and other sign companies count on to conduct their daily business.

Specifically, the stated objectives of InfoTrends’ survey were:

- to develop an accurate picture of ISA member and non-member companies by size, production volume and other metrics.

- to understand how digital printing has been adopted within the sign industry.

- to examine the primary applications for wide-format digital printing and determine which are growing as a percentage of the sign and graphics industry.

- to measure the current wide-format digital printing and media ‘mix’ in terms of purchase volume and other criteria.

Respondent profile

The role of the respondents in this type of study affects both their responses and their ability to respond with reference to certain elements of the survey. In this case, the respondents overwhelmingly represented leadership positions at sign and graphics companies, including presidents, CEOs and owners (74 per cent); general managers (GMs), chief operating officers (COOs) and vice-presidents (VPs) of manufacturing (nine per cent); pre-press and production managers (eight per cent); and VPs of sales and marketing (six per cent). Only two per cent were information technology (IT) managers or chief technology officers (CTOs); and only one per cent of participants were in-plant managers.

[2]

[2]In the 1990s, when shops made signs primarily by cutting vinyl, they needed to manage an inventory of different colours of film.

Another factor is self-identification. With the continuous evolution of the wide-format graphics market, many companies from other, traditional segments of the printing industry have entered the sign market over time, seeking business growth and higher profit margins by expanding their offerings. Hence, even ISA’s own membership now includes companies that do not refer to themselves as sign shops, but instead as ‘digital graphics print shops’ (15 per cent of survey respondents), as ‘digital printing specialists’ (five per cent) and with other print-focused nomenclature.

Most of the shops that responded are fairly small in terms of revenue and number of employees. More than 62 per cent of them list fewer than 10 employees and nearly 70 per cent report less than $1 million in annual sales.

The size of an average sign and graphics shop is an important factor in the dynamics of the industry. While all companies try to run efficiently, small shops are often more acutely affected when issues impact cash flow.

Own or outsource?

One example of how digital printing is enabling more efficient operations is in how sign shops manage their inventory. In the early 1990s, for instance, when shops made signs primarily by cutting vinyl, they needed to manage an inventory of many different colours of films. In digital printing, on the other hand, all of the vinyl is white before being decorated, so there is less need to tie up cash in multiple types of inventory.

Also, many signmakers realize they do not have to own all of the equipment they could possibly need to serve their customers. In some cases, it is advantageous to outsource work they are unable to do in-house. In fact, even while digital printing is the industry’s primary production method, the survey showed a diversity of approaches:

• 21 per cent of respondents do not have their own printers and, hence, outsource all wide-format print production.

• 33 per cent own wide-format digital printers and do not outsource related work.

• 46 per cent have their own printers, but still outsource sometimes.

[3]Further, sign shops often own multiple devices, representing multiple wide-format printing technologies. There are several reasons for this, including the need for multiple devices

to satisfy production capacity requirements;

or a ‘lean’ manufacturing strategy where several of the same type of device are used to provide redundancy.

[3]Further, sign shops often own multiple devices, representing multiple wide-format printing technologies. There are several reasons for this, including the need for multiple devices

to satisfy production capacity requirements;

or a ‘lean’ manufacturing strategy where several of the same type of device are used to provide redundancy.

Despite the rise of digital printing, analogue equipment—including colour cut vinyl plotters and screenprinting presses—is holding on. When asked how many analogue machines they owned, sign shops’ survey responses in this category averaged 2.3.

The next most common multiple in-house printers were aqueous inkjet models at 1.8. This is probably because many shops use one as a proofing system and another as a production system.

Ultraviolet-curing (UV-curing) roll-to-roll and durable aqueous ‘latex’ inkjet printers tied at 1.5, while UV-curing flatbed, UV-curing hybrid, dye sublimation, solvent-based and eco-solvent inkjet printers all tied at 1.3. In other words, shops typically have one of these printers, rather than a fleet of the same type.

Printers of choice

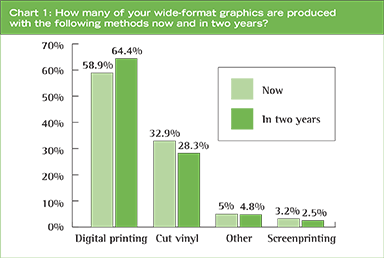

Digital technology is continuing to transform the sign and graphics market. Already, shops report digital printing accounts for more than half of their production output and they expect it to make up a greater share in the near future (see Chart 1).

Eco-solvent inkjet is the dominant wide-format digital printing technology among the sign and graphics shops surveyed by InfoTrends, with 52.9 per cent uptake. This is not altogether surprising, as it is a suitable choice for printing a diverse range of durable graphic applications at a low initial price and with competitive running costs. Some of the most popular eco-solvent devices include integrated cutting systems, providing additional value for small shops that need to contour-cut graphics.

[4]The next most common technology is solvent-based inkjet at 25.3 per cent. While it is clear many sign shops are now shifting some of their print volume away from these machines, solvent-based printing offers very low-cost production for out-of-home (OOH) advertising applications, for which print buyers tend to be highly price-sensitive.

[4]The next most common technology is solvent-based inkjet at 25.3 per cent. While it is clear many sign shops are now shifting some of their print volume away from these machines, solvent-based printing offers very low-cost production for out-of-home (OOH) advertising applications, for which print buyers tend to be highly price-sensitive.

UV-curing hybrid and aqueous inkjet printers tie at 15.3 per cent, followed closely by latex at 14.1 per cent. This latter statistic is notable because latex is still a fairly new option, so its adoption is going well in the sign and graphics market as a replacement for traditional aqueous, eco-solvent and solvent inkjet printers.

UV-curing flatbed and roll-to-roll printers follow at 11.8 and 7.6 per cent, respectively. Of course, when counting all different configurations of UV inkjet printers combined, 34 per cent of surveyed shops own at least one.

While sign shops that own analogue machines tend to own several of them, these shops are no longer as common as they once were. Only 5.3 per cent of surveyed shops report owning analogue wide-format printers, followed by the dye sublimation niche at 4.1 per cent.

Subtle shifts

Subtle shifts

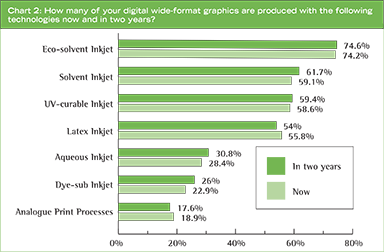

The companies that are investing in higher-end wide-format digital printers typically do so to become more competitive in terms of keeping running costs low and expanding the type of applications they can produce. With this in mind, survey respondents report they expect to make only subtle shifts into various technologies in the next two years (see Chart 2). They anticipate slight growth in eco-solvent, solvent, UV and aqueous printing production, a more notable increase in dye sublimation—faster than any other production method—and, surprisingly,

a small shift away from latex. The changes

in a two-year time frame might seem fairly small, but they indicate the directions sign and graphics producers may be taking.

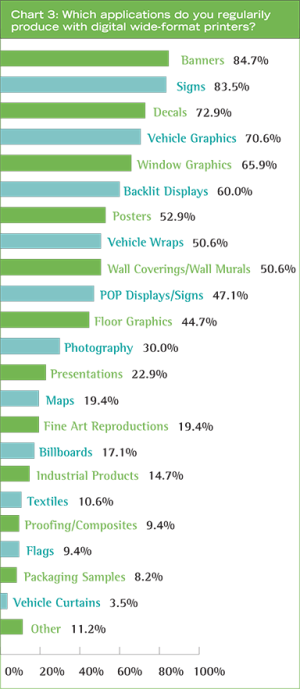

One of the most important considerations when it comes to the choice of technology is the mix of applications the sign shop produces, but here too there has not been much change in the mainstream. When survey participants were asked which applications they regularly output on their digital wide-format printers (see Chart 3), banners and signs were the most common answers, followed by decals, partial vehicle graphics, window graphics, backlit displays, posters, full vehicle wraps, wall murals, point-of-purchase (POP) displays, floor graphics and large-format photography. Less common were fine art reproductions, billboards, printed textiles and flags.

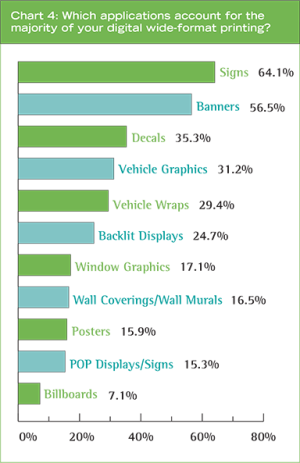

Somewhat similarly, they were asked which applications are the most important or account for the majority of their digital wide-format printing (see Chart 4). As one would expect from a group largely comprising sign shops, their top answer was signs, followed by banners, decals, vehicle graphics and wraps, backlit displays, window graphics, wall murals, posters, POP displays and billboards. (This application mix reconciles with the substrate mix used by respondents, which includes a very high percentage of vinyl.)

Still a growth market

Perhaps just as important as which applications are commonly produced by

sign shops today and what drives the majority of their wide-format output volume are the current trends relating to specific applications. With this in mind, survey participants were asked which types of applications are growing and which are declining, as a percentage of their total digitally printed wide-format volume. There were several important results among their responses.

First, 75 per cent of companies producing signs report they represent a growing application. InfoTrends suggests this is a result of the shops’ customers seeking to change out their messaging more frequently to drive sales activity for their own products and services.

Similarly, wall murals are rated as a growing application by nearly 70 per cent of respondents. InfoTrends credits this not only to another market demand to change out messaging, but also to the emergence of latex inks, which avoid the odours associated with offgassing solvents. Latex-printed wallcoverings have helped bring wide-format graphics to environments with stricter indoor air quality (IAQ) requirements than traditional sign locations.

The trend for printed textiles may be less clear. While 60 per cent of respondents report it is growing, nearly 17 per cent say it is in decline. InfoTrends suggests it is indeed a growth market, but one where new entrants may be negatively affecting smaller suppliers.

It is important to recognize not even one application among all those listed was reported by respondents to be in greater decline than growth. This reinforces the notion that wide-format digital printing remains a growth market overall.

Fragmented substrates

Fragmented substrates

The wide-format digital printing business is fragmented in terms of suppliers, hardware and types of substrates. As a result, many brands of pressure-sensitive media are used. InfoTrends’ survey presented more than 30 of these brands to participants and asked them to identify which, if any, they currently use. While some of the brands came out on top, including 3M, Avery Dennison, Arlon and Orafol (previously known as Oracal), respondents overall report using at least some of all of the brands and, for that matter, 10.6 per cent report using other brands not on the list.

Behind the aforementioned top brands in the rankings was a mix of dedicated vinyl suppliers—including Ultraflex, Mactac, Cooley, Clear Focus, InteliCoat Technologies/Magic Inkjet and Sihl—and wide-format printer manufacturers that provide their own compatible media—including HP, Roland DGA and Epson. Further behind were more specialized substrate suppliers like Fisher Textiles and Value Vinyls.

Survey participants were also asked how important certain factors are in determining which brands of media they use. Their responses suggest most sign shops select products based on practical characteristics like durability, print quality and cost, as they want their customers to be happy with the performance, appearance and price of the graphics they produce.

Other characteristics of importance relate to the value conveyed by the manufacturers and their distribution channels, including a product’s warranty, high availability (in terms of speed) and low roll-to-roll variability. It is interesting to note respondents rate ‘previous experience with the brand’ just as highly as ‘fastest availability,’ which suggests they would be willing to replace their currently used brands with alternatives that are more easily available.

Another interesting finding was the lack of importance attributed to choosing substrates that are least hazardous to the environment. InfoTrends suggests, more than anything else, this reflects the size of the average facility among the respondents. In other research studies, the company has found very large wide-format printing businesses are more concerned with environmental issues because (a) they are more likely to support large customers with their own environmental practices and policies that affect sign and graphics procurement and (b) they are more acutely aware of the cost of disposal for large quantities of non-recyclable materials.

At any rate, the data from respondents reinforces InfoTrends’ perception of the sign and graphics market as a dynamic one where suppliers are challenged to continue to develop products to help expand the sign business, while also streamlining their supply chains.

Comparison shopping

Wide-format media for digital printing are very important cost elements for sign

shops. The average shop spends thousands

of dollars per year on pressure-sensitive vinyl.

Among survey respondents, the mean annual expenditure on wide-format print media was nearly $47,000. Further, sign shops clearly expect their business to grow, as 63 per cent of respondents report they will spend more on media over the next year than they did in the previous year.

The most common digital print output widths among survey respondents are 1.37 m (54 in.), which coincides with the size of many leading eco-solvent printers, and 1.2 m (48 in.), which is very common for flatbed printers.

The growth of UV-curing inkjet printers, particularly the flatbed models, is also driving growth in the use of rigid substrates, which now account for 14.5 per cent of respondents’ output, compared to 85.5 per cent for flexible media. Flatbed UV printers typically require a very significant upfront investment, but offer productivity advantages because graphics can be printed directly onto rigid media without the need for separate mounting in the finishing department.

[5]Among the rigid media mix, the most commonly used substrate is Coroplast, the corrugated plastic sheet manufactured since 1975 in Granby, Que. (and now elsewhere), followed by rigid polyvinyl chloride (PVC) sheets, metal composites, acrylic, polycarbonates and wood fibre composites.

[5]Among the rigid media mix, the most commonly used substrate is Coroplast, the corrugated plastic sheet manufactured since 1975 in Granby, Que. (and now elsewhere), followed by rigid polyvinyl chloride (PVC) sheets, metal composites, acrylic, polycarbonates and wood fibre composites.

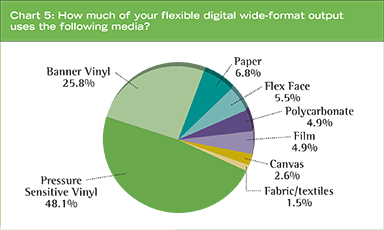

As mentioned earlier, vinyl is dominant in the flexible wide-format media market. Survey respondents report 48.1 per cent of their flexible graphic output uses pressure-sensitive vinyl and 25.8 per cent uses banner vinyl; together, they comprise nearly 75 per cent of the total. Papers, flex-face materials, films, polycarbonates, canvasses and fabrics/textiles account for much smaller percentages (see Chart 5).

One reason for these results is the versatility of pressure-sensitive vinyl, which sign shops use for a wide variety of their top applications, including vehicle wraps, backlit signs, window graphics and wall murals. Almost 25 per cent of their reported use of pressure-sensitive vinyl involves mounting it to a flat panel, however, which suggests many sign shops could benefit from adopting UV-curing flatbed printers and, in doing so, reducing their costs of labour and additional media for mounting.

Within the vinyl segment, respondents report 86.5 per cent of the material they use is adhesive-backed. This reflects their strong focus on signs and vehicle graphics over other non-adhesive-backed applications (13.5 per cent).

Another way to categorize vinyl is coated or uncoated. Respondents say 69.2 per cent of the vinyl they use is topcoated, which is more expensive than uncoated vinyl (30.8 per cent), but typically improves the image quality of the resulting prints.

[6]

[6]Wall murals are a growing trend, thanks in part to latex inks, which have helped them gain acceptance in facilities with strict indoor air quality (IAQ) requirements. Photo courtesy LexJet

Prices also differ between more expensive cast vinyl and less expensive calendered vinyl. Going into this study, InfoTrends had theorized the majority of digital printing volume would use calendered vinyl, but in fact the market was nearly evenly split, with survey respondents saying they use 51.1 per cent cast and 48.9 per cent calendered vinyl. InfoTrends concluded the higher-than-expected rate of cast vinyl consumption was due to requirements for longer-term image durability in the sign industry.

Other services

Finishing remains an important part of wide-format graphics production, especially lamination. Sign shops laminate graphics for

a number or reasons, including weather and graffiti resistance, enhanced durability and

the professional appearance of a glossy or matte finish. Among the survey respondents, approximately 62 per cent of the graphics they produce are laminated.

In addition to printing and finishing, customers demand a variety of other services from sign shops. Of the survey respondents, 73.3 per cent offer delivery, 71.7 per cent offer pre-press services—such as graphic file manipulation—to prepare graphics for printing and 67.5 per cent offer installation.

Future trends

One of the last questions in InfoTrends’ survey asked participants to indicate how much they agree with a series of ‘trend’ statements on a scale of one (disagree) to five (totally agree). With this type of question, ratings averaging above 3.5 indicate strong agreement with a trend.

The following were the results:

• “We count on media partners to develop new products to enable new applications.” – 4.0

• “The supply dealers we use are very knowledgeable about print media.” – 3.8

• “We are interested in media loyalty programs and other incentives to use the same brand from the distributor.” – 3.8

• “The performance warranty is an important part of the print media we buy and use.” – 3.8

• “We are interested in media loyalty programs and other incentives to use the same brand from the manufacturer.” – 3.7

It is logical to see slightly less interest in having a loyalty program hosted by the manufacturer as opposed to the distributor, since benefits of such a program would be realized faster in a dealer-based program where all supplies are purchased from one source, rather than a vendor-based program where the benefits of spending on one specific type of material would accrue more slowly.

There are tens of thousands of sign and graphics shops across North America competing for new and current customers’ business every day, so they are looking for ways to expand their services into new areas of profitability. Suppliers must recognize the demands of both the shops and the end customers, so they can help sign and graphic producers take better advantage of their investments and access new markets.

Glenn Feder is the International Sign Association’s (ISA’s) director of business development. The research cited in this article was sponsored by 3M. For more information, visit www.signs.org and www.3m.com.

- [Image]: http://www.signmedia.ca/wp-content/uploads/2014/11/LEJ-640FT.png

- [Image]: http://www.signmedia.ca/wp-content/uploads/2014/11/roland_gx-640_vinyl_cutter.png

- [Image]: http://www.signmedia.ca/wp-content/uploads/2014/11/Chart-1.png

- [Image]: http://www.signmedia.ca/wp-content/uploads/2014/11/Chart-2.png

- [Image]: http://www.signmedia.ca/wp-content/uploads/2014/11/Chart-5.png

- [Image]: http://www.signmedia.ca/wp-content/uploads/2014/11/WallProSUV.png

Source URL: https://www.signmedia.ca/wide-format-graphics-todays-print-and-media-mix/